Investing in the Enterprise in 2015

Enterprise technology investing is probably in one of the most interesting places it has been in the last 20 years. The confluence of critical technology transition, open source software, mobility, and the consumerization of the enterprise has created fertile ground for the next generation of iconic enterprise companies.

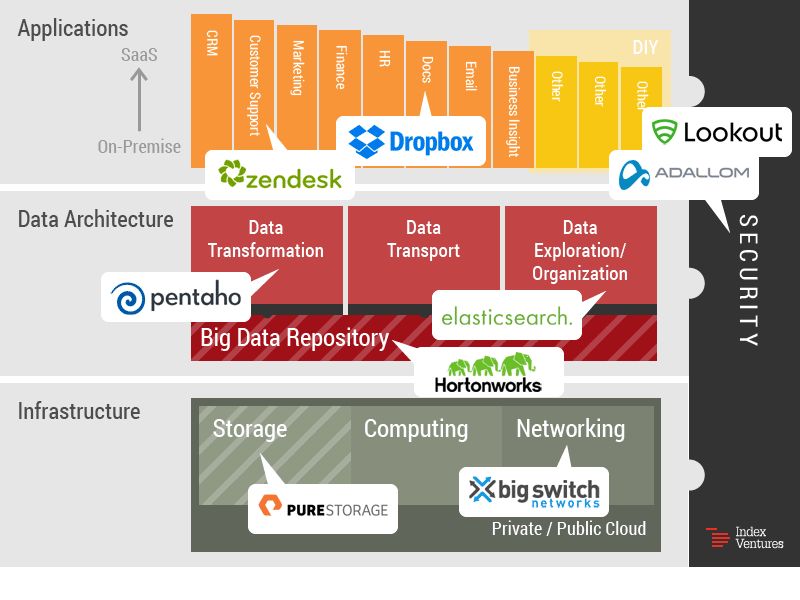

At Index, we’ve enjoyed tracking the massive growth in this sector and have been fortunate enough to welcome the likes of Hortonworks, Pure Storage, Elasticsearch, Zuora, and many others into our portfolio over the past few years. Unsurprisingly, we plan to keep actively pursuing enterprise opportunities in 2015.

To help us interpret the current landscape of enterprise opportunities, we have developed a framework to help us identify what is happening, who the major players are, and where we see the most potential. While simplistic, this framework provides us with a guidepost for not only where we should be looking for great investing opportunities, but also where we should be advising our existing portfolio.

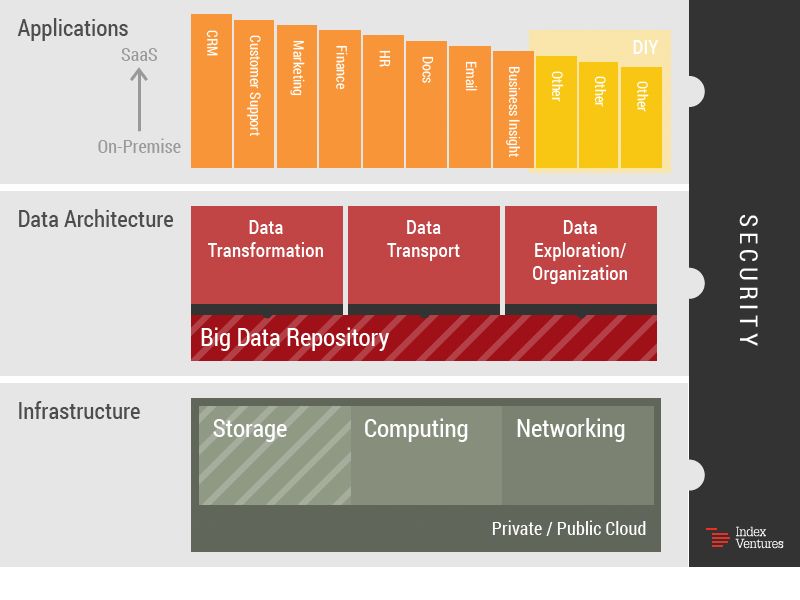

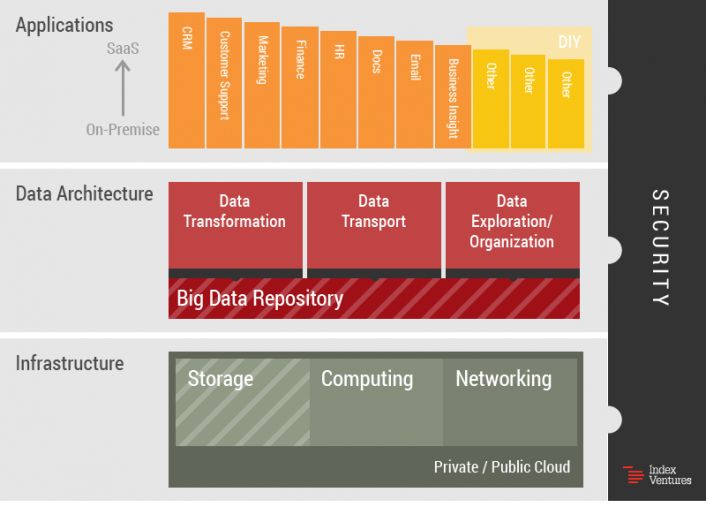

In our view, the enterprise is comprised of a series of “blocks” (and “microblocks”) that are built on top of each other, as pictured above.

While we consider all represented segments prime areas to watch, there are three in particular that I have high hopes for in 2015.

- Data Insights: On the data side, Big Data has been touted as the hot new thing—but, for now, most enterprise customers are just storing and consolidating the loads of data that they’re generating. With the advent of Hadoop, data is both less expensive and actionable. 2015 will be the year we truly figure out how to use big data, visualize it, and mine it for customer insights. Want to know exactly when mobile game players convert from being non-paying to paying customers? Finally.

- Storage: The way storage fundamentally exists is changing, as we’re seeing numerous technological transformations in the field. The most significant one for 2015 is the migration from disk-based to flash (SSD)-based storage systems. In parallel, there is also a trend towards converged storage and compute systems, which combine compute and storage onto a single product. For certain workloads, this is an ideal solution.

- Security: This one seems fairly obvious, but cannot be stressed enough. The notion of cybersecurity fundamentally changed last year. As demonstrated by the Sony hackings, cybercrimes have escalated from just being annoying burglaries to true existential threats. For the last 15 years of security, we’ve just been sticking our fingers into a dyke to prevent a torrent of harm. We now need to reassess the entire system.

While these are certainly amongst the most promising areas, the enterprise technology space is wide and rangy. In order to help us provide some structure and sense of prioritization, we’ve assembled the vast opportunity set in a framework that serves us as useful map for navigating these fertile grounds.

The Infrastructure Layer

The bottom layer of the chart represents the Infrastructural building blocks of any enterprise technology stack. This is true whether it’s in a cloud or “on premise,” or if a customer choses to build a technology platform themselves or buy it as a service from a cloud provider. As mentioned above, Storage has been a terrific investment sector over the years and continues to be the site of numerous technological transformations.

Pure Storage, one of our portfolio companies, is driving right at the heart of a critical transformation in storage technology. Their “all flash” storage arrays present a paradigm shift to the classical disk-based world. Pure’s success would certainly indicate that the world is ready for this transition.

The Computing block represents where computational tasks at their most elemental level happen. Historically, this market has embodied itself in the form of chips and servers. While there are a few companies trying to reinvent the basic compute unit, much of the innovation has been about developing the compute layer into the cloud.

The last of the infrastructure blocks is Networks. With a few exceptions, the networking sector has been the land of the incumbents, with Cisco as the primary beneficiary of the status quo. The last decade has not brought a lot of innovation to this sector. But two trends are interesting today. One is the advent of “merchant silicon” for networking —it’s a trend that is steadily replacing the old approach of monolithic vertically-integrated products. The other is the advent of Software Defined Networks (SDN). This novel approach to networks re-centralizes network policy and switching decisions, thus making the network far easier to manage and program. Our portfolio company, Big Switch Networks is leading this disruption that will upset the classical networking landscape.

The Data Layer

The middle section of the opportunity map is the data layer. Here is where data lives its life in the enterprise world. It is also an area that is going through significant upheaval due to recent technological changes. To create a bit of order here, we break the opportunity space into four broad “buckets.”

First is the Data Repository. This is where information lives. Data stores range from long term resting places for data to temporary locations that offer the ability to perform high-speed transactions against it. The biggest current trend is around “big” data, which requires systems to store exponentially more data than was commonplace in the past. Depending on the nature of the workload requirements for the data, there are different types of next generation stores, but clearly much of the attention goes to Hadoop and its derivatives right now. Hadoop is a very unique store in that it is both a repository for data and a compute architecture for data as well. So, it doesn’t neatly fit into a block. Hortonworks provides the leading all-open Hadoop distribution, HDP. Just 3 years old, Hortonworks has grown up at breakneck speed and is now a publicly traded company.

The second key block is about Data Transport and moving data around to the right stores for its source. Sources for data are varied—they can be logs, sensors, outputs of computational processes, or others. Typically this data is needed by multiple applications and needs to be routed to the right stores such that applications can have access to it. Data transport is a complex task that was once performed by solutions like MQseries or TIBCO. But, this sector is being revolutionized by big data capable architectures like Apache Kafka. Growing number of applications that are hungry for this data, this will be a big market for sure.

Data Transformation is the third major block. Data sources product information in all sorts of ways. Data can be structured or unstructured, and even when it is structured, it is often structured in the wrong way. So, a lot of computing is about transforming data into useful formats. The formal name given to this part of the data lifecycles is Extract, Transform, Load (ETL). ETL has also been around for some time, but not in the context of big data and many of the unstructured big data repositories like Hadoop. So, the real opportunity is, once again, the adaption of data lifecycle process that has been around for a while into a modern, big data architecture. Our company, Pentaho, with its Kettle framework is a leader in this area.

The last exciting block in the data universe is about Data Exploration and Organization. With all this data appearing everywhere in increasing volumes, finding the right information in a fast and expedient manner is more challenging than ever. Google certainly figured out how to do this for the Internet itself, but there is even more data that exists in non-public environments which needs to be organized and explored. This block is really about making sense from data to gain insights or knowledge. Elasticsearch, another one of our companies, is making huge headways in this sector and is providing its users and customers a cost-effective and massively scalable way of making sense of their proprietary data sets.

The Application Layer

At the top of our opportunity map is the application layer. Applications have undergone a massive transformation in the last few years based on a few standout trends. The most obvious is the evolution from packaged and on-premise software to SaaS-based applications. This megatrend has created a new leader in virtually every major functional software category. In the CRM space, Salesforce.com has all but decimated the incumbent Siebel System. In HR, Workday has taken over where PeopleSoft left off. Netsuite, ServiceNow, Marketo… the list goes on. In fact, some of these SaaS players have become so significant that they have effectively monopolized their categories. Our belief is that challenging these SaaS leaders is a tough task right now, and, it’s more likely that the next generation of SaaS opportunities will come in categories outside of the primary verticals.

In addition to the SaaS evolution that package software solutions are going through, home-brew or DIY software is also moving to the cloud. Developers are moving to cloud-based development environments in hoards, and the applications that are born of them in the cloud remain in the cloud. Here too, there is significant opportunity in managing, performance enhancing, and scaling enterprise cloud applications.

The Security Axis

Security, in particular, is one of the truly evergreen categories in the venture world. Year after year, great security companies find a receptive market at every layer of the enterprise architecture. This is in part because the cat-and-mouse game played by hackers and protectors in the technology world is never-ending, but also because several of the megatrends affecting enterprise technology right now have massive security implications. That’s why security encompasses all three layers of our enterprise framework.

Within security, two trends worth highlighting for 2015 are mobility and cloudification. Enterprises have to deal with an ever-mobile workforce and customer universe. Additionally, a growing number of both packaged and ad hoc applications live in the cloud. This presents a secular shift in security thinking. For one, a significant part of traffic will go from mobile device to application in the cloud. Much of this traffic will never touch the classic enterprise. So, traditional “perimeter security” approaches are likely to be not as helpful. Furthermore, a competitive enterprise organization is necessarily becoming more porous. So, having a different security architecture that can deal with “openness” is ever increasingly critical.

We’ve been prolific investors in the security space and some of our companies have already developed into leaders in their segments. Lookout is the leader in the mobile security space and had taken advantage of the “always connected” world to develop and entirely new way of protecting devices. Adallom has seized the migration to cloud & SaaS services that many enterprises are embracing and developed a unique solution to secure the use of these off-premise services.

2015 will be a fascinating year for the Enterprise, and we’re excited to see what the next twelve months will bring and how they line up against our expectations in the sector. Ultimately, however, as investors, we’re not just trying to prioritize a market segment. Rather, we’re looking for a match between a segment and an interesting entrepreneur. If you end up only prioritizing the former, then you’re forgetting about the latter, which is anathema to us at Index. This framework may be the soil of what we do, but in the end, we’re betting on the farmer. And we can’t wait to work with the next great enterprise entrepreneurs to see how they can change the business landscape.

Published — Jan. 20, 2015