Rooser: Turbot-charging seafood trading

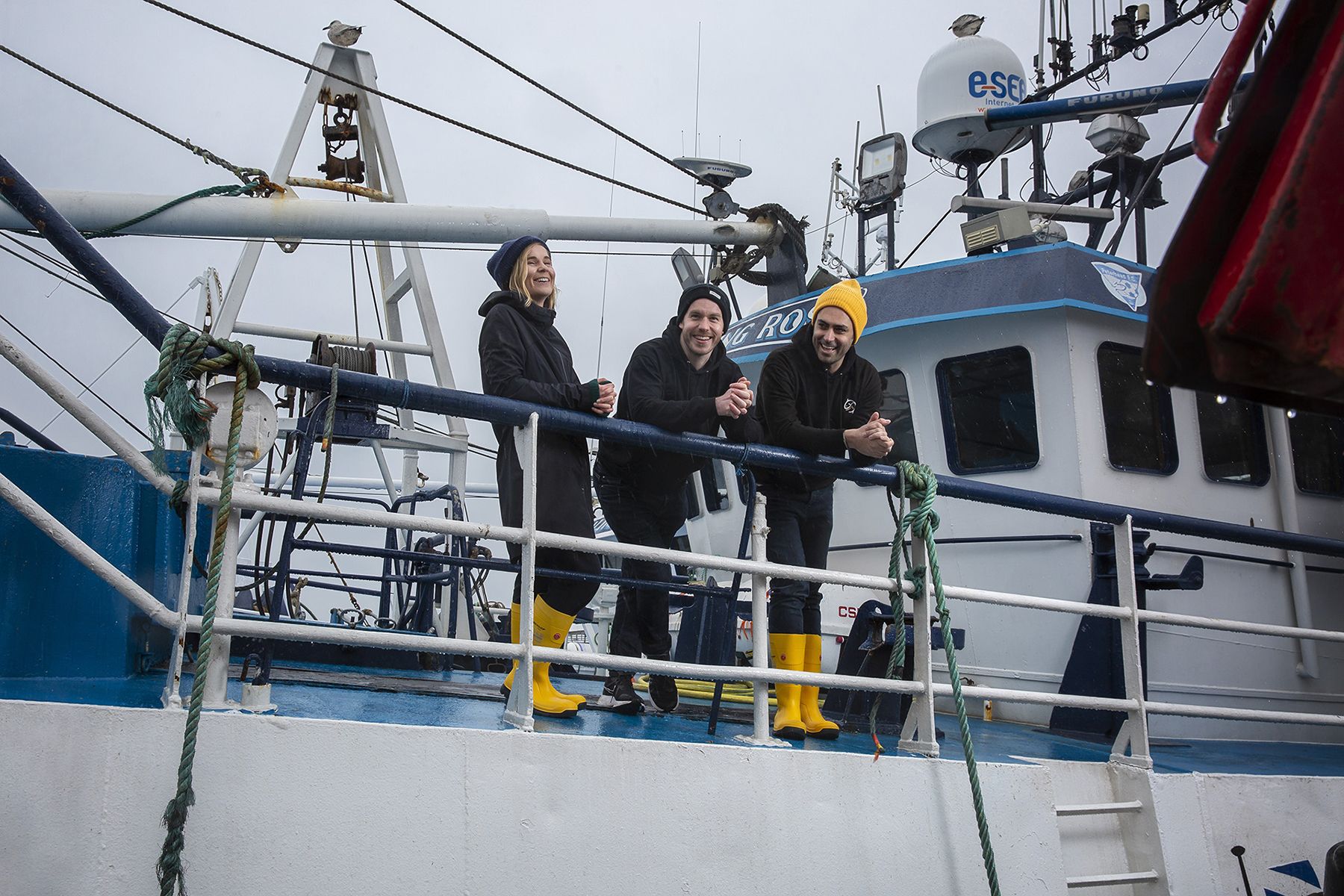

Rooser co-founders Joel Watt and Erez Mathan with Index's Georgia Stevenson in Peterhead, Scotland.

Photos by Jess Shurte.

Fish processing in Peterhead, Scotland

Fish market in Peterhead, Scotland

The evolution of the stock market, and how it operates today, all began with boats and their cargo.

In 1602, the Dutch East India Company issued the first ever recorded IPO. The idea was to subsidise the upfront costs of embarking on a voyage and, in return, investors would get a share of the goods they brought home. Because ships often took years to return, and were at risk of pirates, wreckage, and unforeseen calamities, the concept of fractional ownership was introduced – that is, diversifying investor risk across multiple ships and issuing cross-vessel shares.

These shares would go on to be traded in coffee houses throughout Europe and across the Western world, with buyers and sellers travelling widely to transact. First they’d cluster around specific physical locations, be that harbours, Buttonwood trees or Wall Street, before expanding to broader remits via the likes of fax, telephone and ticker tape.

This all changed in 1971, when NASDAQ was formed to trade securities electronically. By 1991, 46% of all US securities were traded there. Over time, other exchanges caught up, and today trading online is the norm.

Meanwhile, amidst these centuries of change, boats and their cargo – the very catalyst for innovation in trading – have been left high and dry. More specifically, fish and seafood transactions still take place predominantly offline, clustered around physical locations, and driven by networks and relationships.

Every year, around €140bn worth of fish and seafood is traded within Europe. This fish is caught by fishermen and sold to processing plants. From there, these processors sell to wholesalers, who in turn, sell to retailers, be that supermarkets, restaurants or fishmongers. In the middle of this chain, the transaction between the processor (the seller) and the wholesaler (the buyer) happens daily, if not hourly, and is similar to how stocks used to be traded offline.

Every year, around €140bn worth of fish and seafood is traded within Europe. This fish is caught by fishermen and sold to processing plants. From there, these processors sell to wholesalers, who in turn, sell to retailers, be that supermarkets, restaurants or fishmongers.

Just like brokers, these processors don’t know what fish or stock they’re likely to get, or when. What’s more, when they do get their fish, they don’t really know how scarce the stock is relative to other sellers, which makes it impossible to price fairly. Finally, when they’re ready to sell, they have to start calling up their book of wholesalers one by one, while sending text messages, faxes and emails to ascertain demand and push supply.

Even more stressful than stocks, is the fact that seafood has a very short shelf-life. The longer the fish is out of the sea, the more its quality, and therefore its price, depreciates. Imagine trying to sell a stock when you know the share price is going only one way: south. What’s more, this is a physical good, so you don’t just waste margin, you waste product.

Shockingly, for every two fish that make it to your plate, one doesn’t.

Given our appetite for seafood is larger than ever, and that scrutiny over sustainable fishing is higher than ever; efficiency and waste reduction is increasingly critical for all stakeholders.

With Rooser, fish processors can reach more buyers and reduce waste, while wholesalers get access to the stock they need much faster than ever before

In response to this escalating chaos, Rooser is an online platform and software that empowers fish and seafood traders by up-levelling their infrastructure to sell to more buyers, more quickly, and with less waste.

Its real-time online marketplace aggregates and connects fish processors with wholesalers. For suppliers, this enables them to upload, price, and profile their daily fish stock. Instead of calling up their network, they can automatically push all their stock to sell to whoever bids first. For buyers, this enables them to search, negotiate and transact directly; they can also filter by species, fishing area, fishing method, delivery time and, most importantly, quality score.

The result, for both sides, is quicker, more efficient trading of higher quality produce – enabling buyers to find the right fish, at the right price, at the right time.

Having already partnered with 250 seafood processing factories and wholesalers across 13 countries, this is only the beginning for the Rooser team. When I first met co-founders Joel, Erez, Nicolas and Thomas, their intuitive sense of the customer was incredibly clear, as was their searing ambition to finally give seafood traders the platform they deserve.

We couldn’t be more excited to lead their $23 million Series A, and to partner with them to go after such a massive oppor-tuna-ty. It’s about time.

Rooser co-founders Nicolas Desormeaux and Joel Watt

Rooser founding team Thomas Quiroga, Erez Mathan, Joel Watt and Nicolas Desormeaux (from left to right)

The Rooser team in Edinburgh

Published — April 25, 2022