Backing Sylvera to bring trust to the carbon offset market

If the world is going to stand a chance of preventing runaway climate change and wholesale ecological collapse, we need a revolution in both thought and deed. This will demand new, robust ways of measuring the environmental consequences of our actions, as individuals, countries and companies.

Business has taken on a key role in the endeavour of achieving a carbon-neutral world, committing $37 trillion of institutional capital to achieving net-zero emissions – a fourfold increase from the amount of money pledged by the end of 2020. Fulfilling these commitments will involve a reduction in emissions, an investment in technological breakthroughs, and an offsetting of emissions that cannot be eliminated.

‘Offsetting’ is a dirty word for many in the environmental movement. One fear is that offsets are misused as a license for companies to continue emitting, while purchasing the equivalent greenhouse gas reductions in forest acreage. Another worry is the validity and impact of the reforestation projects being purchased.

To invest in a carbon offset project today, you’re dealing in a 'wild west' of intermediaries, some more reputable and reliable than others. Moreover, assessing CO2 savings involves a patchwork of divergent and time-consuming calculations, with lots of potential for error

Sylvera, founded in London in 2020, responds to this need. Dr. Allister Furey, a serial renewable-energy entrepreneur, and Sam Gill, a lawyer who gained exposure to the problem on the advisory side, were struck by the challenges in the carbon offset market. They recognised that offsets are an essential part of our toolkit as a complement to, rather than a substitute for, a reduction in emissions – but these transactions needed to become much more reliable. With current technological capabilities they realised they were able to provide the data needed to make the carbon offset markets much more transparent. Doing so would lead to more investment in the most impactful carbon mitigation projects.

With the belief that developing trust in the carbon market is essential, Sylvera built a platform that independently rates carbon offset projects. The company never sells offset projects itself, so there isn’t a conflict of interest. Rather, it exists to set the global standard and act as a stamp of quality for projects as an independent carbon-offset rating provider. On a single platform, it offers a rating for the quality of each offset project, an indication of prices across the market and the ability to monitor the impact of the project over time.

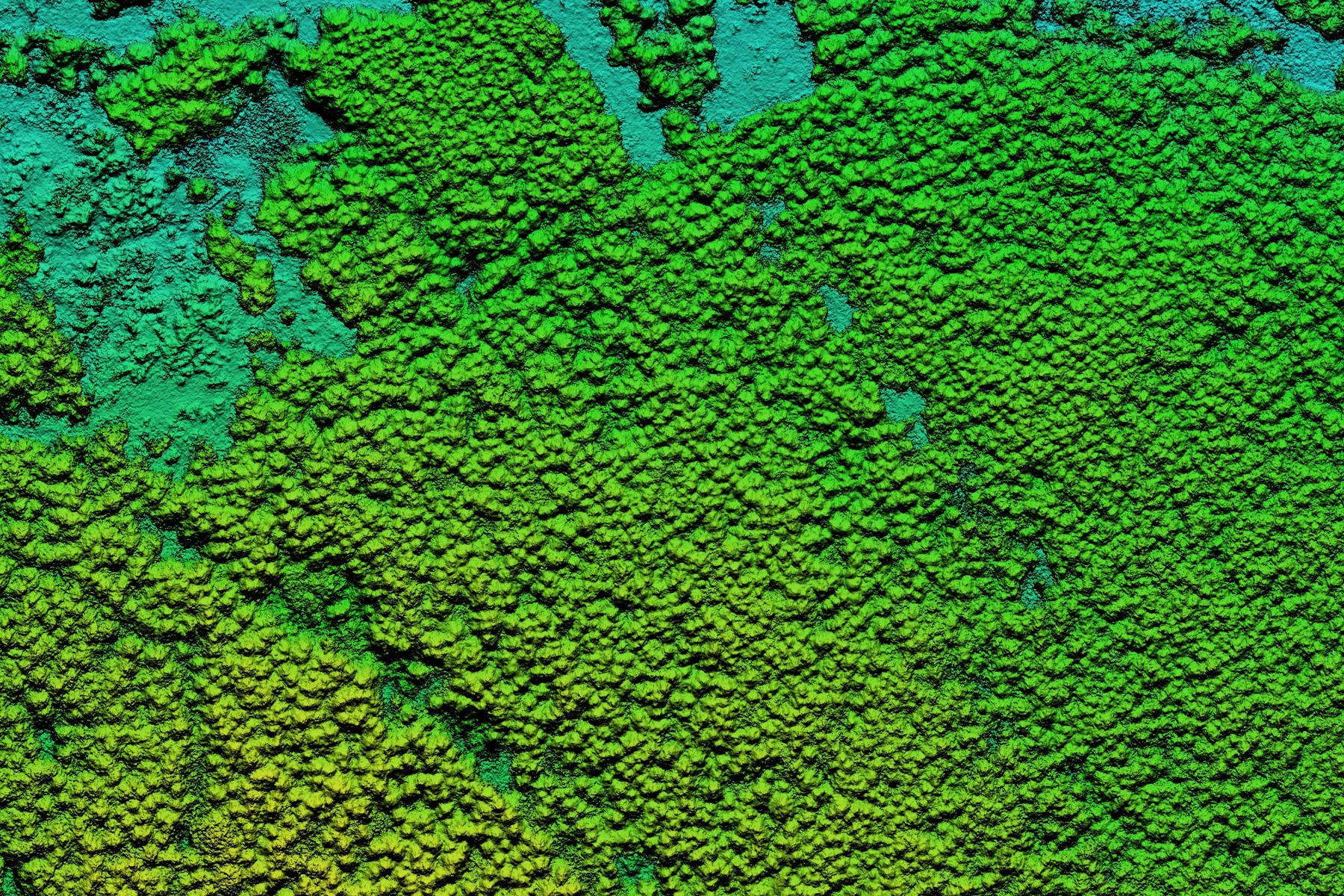

Sylvera is underpinned by the most cutting edge technology available today, developed in partnership with researchers from the most advanced institutions in the field, including UCLA, NASA and UCL. They apply machine learning algorithms to satellite and proprietary data to better assess the quality of offset projects. What before might have involved an annual in-person visit is now a real-time digital feed; what before involved taking a small sample of a forest to make a claim about a larger area is now calculated much more accurately as machine learning is applied to multiple satellite data sources including multispectral imagery, radar and LiDAR.

As we transact online across the world in the digital age, the currency of trust becomes essential. At Index, we’ve backed a number of global platforms that tackle this challenge, including Trustpilot, building the trust layer for the internet.

For now, the carbon offset market is a nascent industry and we expect to see much change as all organisations and individuals go on a learning journey together. We believe that Al, Sam and the Sylvera team are well poised to lead us on this journey and we are pleased to announce leading their seed investment of $5.8m and the launch of their platform.

Published — May 13, 2021

-

-