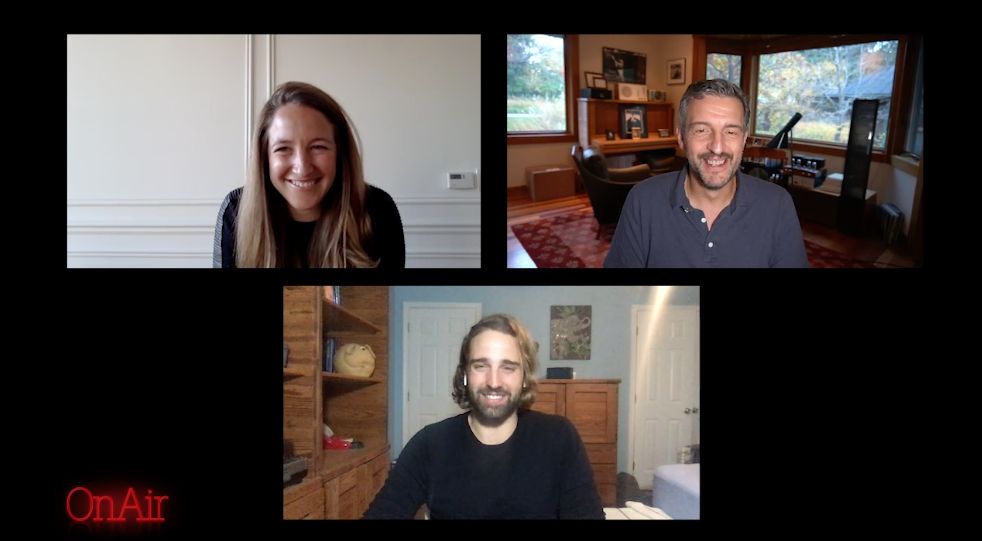

Index OnAir: Looking Forward- 2021 and Beyond (Part II, The Startup Landscape)

After an overwhelming year, there is finally some hope on the horizon. Index principal Bryan Offutt joins partners Sarah Cannon and Mike Volpi for an in-depth discussion on a disruptive but transformational 2020.

Bryan Offutt: Have you found a silver lining in the cloud of 2020, and what do you think 2021 looks like?

Sarah Cannon: There's a great quote about necessity being the mother of invention, and that a crisis is a terrible opportunity to waste. One thing that has happened as a result of the pandemic is that we’ve realized how much work we can do remotely from all over the world. The societal implication is that far more people can enter the labor force, because until now employment centers have been centered around cities. We have all these stereotypes about what work looks like and what an office and a job should be, and that’s all been blown up. That creates more opportunities for a broader set of people.

Mike Volpi: A lot of things in my professional life that gave me great pleasure, intellectually or emotionally, I took for granted. Travelling, going into the office and seeing Sarah and Bryan, and meeting with founders and entrepreneurs, which is one of the most fun things we get to do.

I’ll always respect the opportunity to meet physically, rather than on screen. The pandemic has taught many of us to cherish and appreciate those things more.

Sarah: I had the great fortune to live in Ghana for a year where I took cold showers every day. Fourteen years later I still feel grateful when I have hot water. So one of the interesting questions will be how long the impact of the pandemic sticks with us. As investors, we’ve seen behaviors change — the shift to online payments, groceries, education — how much of that is going to persist?

Bryan: It’s a pretty interesting combination, this appreciation for the mundane, but excitement for the future because we have so much pent up energy. Heading into 2021 with the vaccine kicking in, have you seen any sign of that impacting the startup market?

Mike: Many digital categories haven't been as bad as we thought. And if they weren't that bad through this pandemic, imagine how fantastic things will be when life gets back to normal. We’ll experience a euphoria around startups — formation, funding, rapid technology deployment. We have a government using aggressive policies to stimulate the economy, and that will probably continue given the employment rate. And if all that is true, then we’ll experience a very bullish market. We’re going to have a new administration with a new leader of the Treasury and Fed. But I’d expect a very optimistic first half of 2021, and then we’ll see what the second half holds once we know more about government policies.

Sarah: It's too soon to tell on the impact of the vaccine on the market. There is a lot of optimism, but there’s a lot of implementation that has to happen for the vaccine to impact people’s behavior. They have to trust it and trust it is safe, and that process is going to take a while. But we are in longer-term investments where we partner for seven to ten years, so even though we’ve seen a slowdown, entrepreneurial activity the world over has remained robust.

Bryan: A particular set of companies are going to come out of this, partially as a result of the change in work environment. Can you tell us about some of those opportunities?

Sarah: A lot of the new companies we've seen created are video native. Video was not embedded in a lot of the kind of software products that we use, so those have had an acceleration. That ranges from telemedicine and education to virtual conferences, all getting more traction from offline experiences being moved online. The second trend has been innovations in transactions, contactless and digital payments which has been talked about a lot. And then there’s food delivery. It used to be a smaller segment of people in cities that had groceries delivered or got takeout, and the economics for those businesses had traditionally been harder. Now there’s a border set of products being delivered, and they have scale.

Mike: It’s interesting that all those trends are substitutions of what used to be human-to-human analog interactions. It used to be that when I went to the grocery store, the only digital part was the checkout and the rest was a very human process. But now if I use Instacart, there's an enormous amount of digital engagement that's happening before even the checkout. And all these services produce an enormous amount of downstream data.

Every business that can harness that data exhaust will do really well. That's why we're going to see so many interesting companies that organize, interpret and query data. They will be the beneficiaries of this shift from analog to digital, inventing new products we haven’t seen before.

Bryan: Pair that growth in data with some of the advances in natural language processing, and the future looks very exciting. Two generations ago we engaged with the past through photography, and then it became video. But now we’re collecting everything from text messages to video, you can imagine a new way of engaging with people from the past. Machine learning could recreate a conversation with that person. Waxwork museums could allow us to have conversations with celebrated people; that’s all a positive outcome of this technology. But every technology has its dark side, and the collection of data has been a high profile issue during 2020. What are your thoughts on the direction of regulation, and sensibilities around the use of personal data? How would tighter restrictions limit what we might be able to build?

Sarah: Massive gaps have been exposed in our regulatory infrastructure. I was fortunate to work for President Obama during the last financial crisis. There wasn’t any regulation in this area back then. With social networks, people are uploading content at a rate which humans certainly can't regulate; even algorithms can’t do a good enough job of blocking inappropriate content.

John Maynard Keynes, my favorite economist, says rules of the road are needed for an economy to function, and we don't yet have rules of the digital world or of artificial intelligence. The nature of AI is that more data makes it more predictive, so that will increase the winner-takes-most dynamics. That's going to have massive implications for concentrations of markets, and how we want to regulate that.

On my first day at Index I went for a walk with Mike during which we discussed monopoly. He said it was defined by being able to influence pricing, and I said that might have to be redefined to include the amount of your attention something holds.

Mike: Index is pretty globally minded, and one of the benefits of that is an understanding of complex cultural differences, and what is and isn’t acceptable in different markets. The discussion about raising antitrust standards is very different in the US than in Europe. Even within the United States, some states will follow California’s example of the Consumer Privacy Act (CCPA), and some won’t.

There are extremely different notions of what is acceptable when it comes to personal privacy depending on where you are. It’s too complicated, oftentimes, for the consumer to choose, so a business has to choose the acceptable default on behalf of consumers. It will be tough to harmonize this globally, and we're going to be struggling with for years.

Sarah: Do you think there's going to be a new international regulatory body? Whenever there is disharmony, there has been the World Trade Organization or the United Nations for foreign policy issues, or the International Monetary Fund for economic ones. Is there going to be a regulatory institution for technology data?

Mike: The complexity will be how the US behaves, because the biggest beneficiaries have been US companies: Google, Facebook, Amazon and Apple. Europe doesn't have companies like that, at least for the time being. Europe's kind of natural inclination, through some kind of regulatory consortia, will be to more heavily regulate the American tech giants that have so much control. In the US it's not as black and white. These companies employ a lot of people and increase the strength of the United States from a global perspective. Leaving China aside, the US would never join this type of an organization because their ideas around privacy are completely different.

Bryan: Look at the issue of misinformation around the election, where Twitter and Facebook had very different approaches to that problem because it's so complex and nuanced. Even getting to a place where there's agreement within a single country is difficult enough, much less internationally. Are we moving into a world where the expectation of the consumer and the employee is that private institutions take a more active role in social issues like privacy or diversity?

Sarah: The combination of Black Lives Matter protests and the pandemic mean that a lot of people’s trust in government is very low, if it wasn’t before. This is substantiated by data. The upshot is that people now expect more of the companies they work for. Slack employees expect Stewart Butterfield to do something about diversity and climate. Some of this is a generational, because a lot of millennials have different views about the roles of companies in society. It’s a challenge for founders who are trying to be thoughtful and want to be responsive, but it's a lot to take on while building a business.

Mike: I expect different companies to take a different stance on these issues. We've already seen the folks at Coinbase saying ‘this is a place of work, so check your political and social belief systems at the door,’, while other companies have leaned in more. It’s OK to have that range, and I don't think it should be legislated. Individuals, especially in tech, have a lot of choice where they work, and can choose somewhere that aligns with what they believe a company's responsibilities are. The beauty of American capitalism is the companies with the correct position will become a center of gravity, attracting more talent, and encouraging other companies to adopt that perspective. We should let this happen in a natural and capitalistic way, and see how it plays out.

Sarah: I agree there should be latitude for companies to decide, and for employees to have choice.

But I worry that we've seen a polarization in the United States, and I don't want companies to end up being partisan. There's a delicate balance between taking a stance, and being overtly political.

I don't want people to feel like if they're of different views, they can't work at certain companies, and I've seen that for the first time in Silicon Valley over the past months.

Bryan: It's true of customers, too. If they know an organization doesn’t support causes they care about, they won't buy from them. You see this a lot around sustainability. At the same time, Silicon Valley has a tremendous amount of influence in the world, so it’s a founder’s responsibility, the community’s responsibility to push things forward and create a world that’s better. On that note of optimism, what are you most excited about for 2021?

Sarah: The revival of collectivism. We've all had to change our behaviors and be a lot more aware of our collective responsibilities. I'm optimistic about that as a human being. As an investor, I'm excited about consumer platforms, about limiting some of the existing platforms so they can acquire new startups, about the online communities that have been created during this pandemic, and about the appetite for people just to connect meaningfully. I want an online dinner party where I can connect with people all over the world! There's something deeply human about the need to belong and be with other people, and that’s going to show up in a lot of great products in the years to come.

Mike: I'm excited about living in a hybrid world. We’ll get to enjoy some of those ordinary things we’ll appreciate much more, but we’ll also have a toolkit on how to work, play and learn online. We’ll learn how to balance those two, because humans are good at figuring out the optimal set up for our lives, and will have a broader set of tools. We'll be able to work better, enjoy our friendships more, and be more productive. So 2021 is going to be an interesting and optimistic year.

Bryan: I'm excited about the return of industries that have been struggling, the huge portions of the economy that have been extraordinarily negatively impacted by Covid-19. On an individual and technological level, I've seen a lot of friends use this as a catalyst to do things that they've always wanted to do. And maybe we're shifting to a work environment that's conducive for those kinds of life changes, whether that’s living in the mountains or going back home to Maryland. It’s really exciting to give people the flexibility to live their lives in the way that is most conducive to their happiness.

*This transcript has been edited for clarity and brevity.

Get more insights into the start-up landscape, more Founder interviews, and Company perspectives by subscribing to our channel.

Published — Dec. 18, 2020