Cash App: from Bank to Pop Star

Cash App is wildly underestimated by the market. It's disrupting the $1T banking industry, well-positioned given the structural advantages neobanks have over legacy banks. But what is the brand value of a company that has turned a bank into a pop star? Our partner Mark Goldberg shares his perspective.

2022 has been a tough year for fintechs: the market is down ~50% since peaks in Nov '21, and neobanks like Sofi, Cash App etc have been particularly hard-hit. Lots of people think the space is overheated...will their popularity outlast the pandemic? Will they ever make 💰 ??

These are important questions, but miss the bigger picture - in the long run, a 10x product wins the market.

With <10% of consumers today using an online bank as their primary account, there’s a blue ocean opportunity for the market leader in a massive industry.

Neobanks have 3 structural advantages over legacy banks:

- Distribution

- Product

- Brand

Let’s break down each of these with respect to Cash App.

[1] DISTRIBUTION

Banks spend $100s of dollars to acquire users. Cash App spends $10. p2p transfers + a powerful brand = viral growth.

@jack often talks about the network effects of the biz.

While CAC has increased in the last year, it’s still incredibly cheap, and on par with the best consumer platforms in the world – not anything like legacy banks. This is an extremely unique (and efficient) engine 🚀

[2] PRODUCT

Cheap growth doesn't matter if users aren't valuable.

This is one of the most misunderstood parts of the story - people think Cash App will never generate profits from a user base that is predominantly under-represented in the financial system.

I disagree.

Cash App will make $ because it’s not just re-bundling a bank around its transfer product; it’s building a better bank.

Features like free tax filing, fractional shares, & crypto are pushing the envelope of what customers can expect.

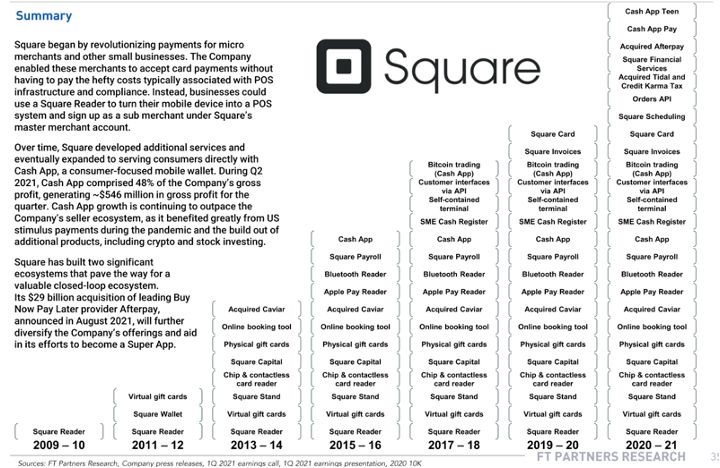

Cash App’s product velocity is head-spinning (see below). In a world where features can be copied by competitors, the slope of product growth in fintech is more important than the intercept. 📈

Finally, the best products are built by the best technical teams.

Cash App is still the Navy Seals of consumer finance talent. 🎖️

This bodes well for the future and explains the speed at which they’ve been able to innovate.

[3] BRAND

When you think about a legacy bank, what’s the image that comes to mind? Marble columns, bank tellers, suits and ties.

Cash App’s greatest coup has been to refashion the image of a bank from a branch to a Nike store

Cash App has become part of fashion, culture, and music (hundreds of shoutouts in songs)

Artists don’t rap about Apple Wallet.

Travis Scott, Megan Thee Stallion and Cardi B don’t partner with JP Morgan.

How do you put a price on cool?

The first time someone asked me this question was as a junior i-banking analyst working on the IPO for Tesla.

I wrote about it here.

The takeaway: it’s hard to value a brand (Tesla stock is up ~500x from IPO, and is now worth more than all other carmakers combined). What could Cash App do to Wells Fargo, Chase and BofA?

Success is not a foregone conclusion for Cash App - they have a lot to prove.

Retention is a big challenge, they need to increase new product attach rates, and they need to reach up-market segments where competitors like Chime are formidable.

Final thought: I’m not an investor in Block, and Cash App is just one part of the larger business. It’s a complicated stock with a lot of potential + a lot of risk.

But, Cash App has done something incredible in fintech - it’s made money cool.

Note: This is a slightly edited version of @Mark_Goldberg_'s original post on Twitter.

Published — March 30, 2022