Codat raises $40M and expands its API infrastructure for SME data

Codat, the technology company that enables small businesses to seamlessly share business and financial data with financial and other service providers secures $40 million from investors, following 300% annual growth and doubling of headcount. It has also announced the expansion of its APIs to include payroll and commerce data, broadening the data sets that flow through Codat.

The Series B round is led by Tiger Global, whose other investments include Stripe, Brex and Checkout.com, with existing investors Index Ventures and PayPal Ventures also participating. Codat plans to use the funds to expand its US presence following the launch of the New York office in January this year, add new data products to its API, accelerate hiring, and onboard new customers. As part of its growth strategy, the company will also expand its San Francisco office as more startups building the next generation of products and services for small businesses, choose to run on Codat.

Codat’s API powers services of five of the world’s largest financial institutions, 12 technology unicorns, and many specialised SME providers. These include Brex, Clearco, Zettle by PayPal, FreeAgent, Pipe and Virgin Money. Clients leverage the Codat API for a wide range of small business products, from loan applications, accounting, expense management and insurance products to e-commerce and point-of-sale platforms.

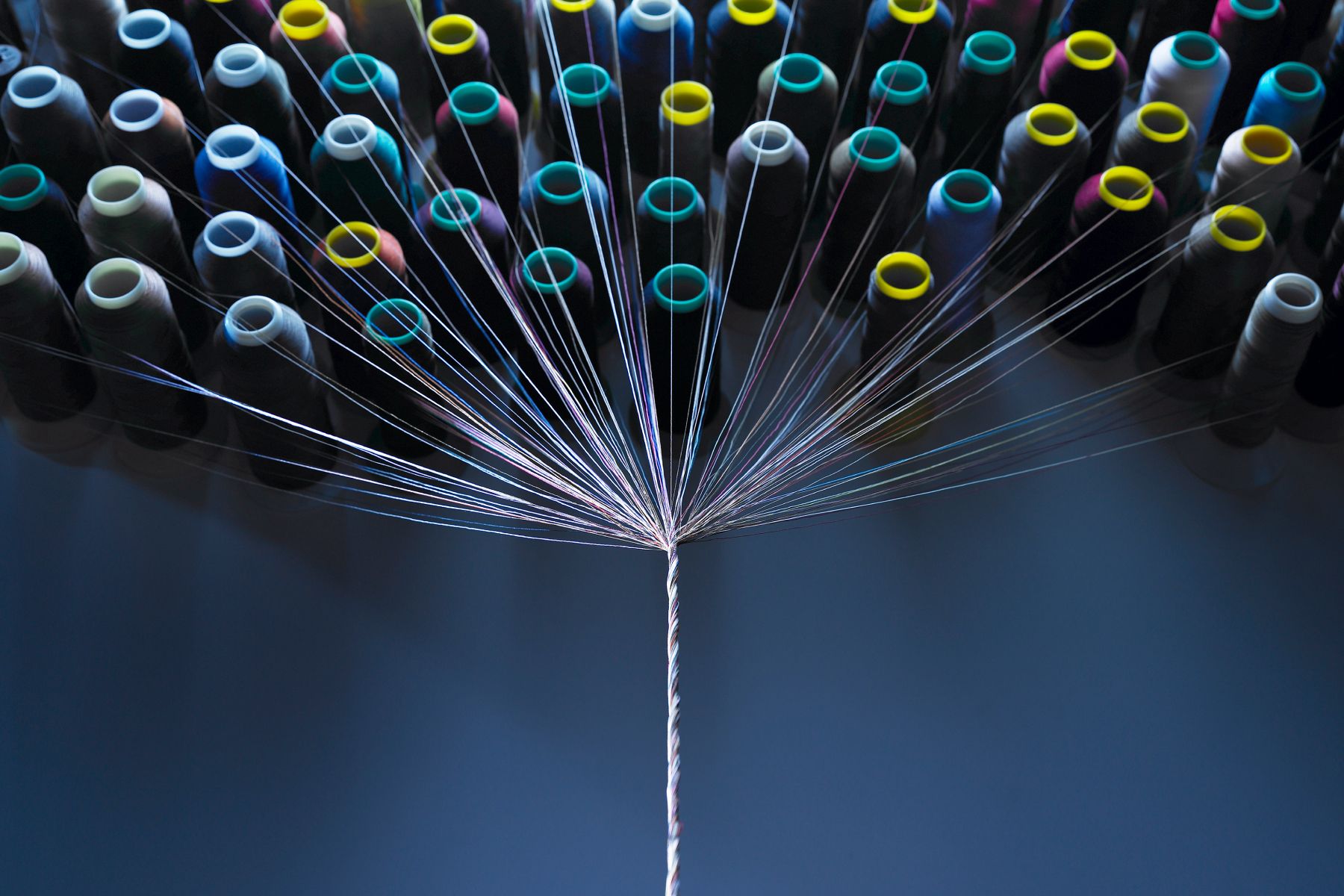

Codat’s mission is to make the lives of small businesses easier and enable suppliers to small businesses, through a single standardised API, to connect with all the software packages SMEs use. Through this API, they can quickly and easily integrate their products with all the other applications used by their business customers, creating a better, more connected experience. On average a typical small business now uses more than 40 different applications.

“The number of SMB-focused software products will continue to proliferate, and we expect many of these products to be powered by Codat in the future,“ said John Curtius, Partner at Tiger Global. “Codat’s customers consistently told us that Codat’s value proposition is incredibly compelling – a faster and better solution at a fraction of the cost as compared to a do-it-yourself approach.”

Peter Lord, CEO of Codat commented: “Financial services for SMBs are now changing more and more quickly, and we’re privileged to work with the people and companies who are driving this change to make life better for small businesses. As Codat is the platform on which more and more of this revolution is built, this investment accelerates the industry transformation.”

Published — July 1, 2021

-

-