Five Fintech Predictions for 2023 – The Investable Surprises

In his annual series, our partner Mark Goldberg shares five fintech predictions for the year ahead. Doom & gloom is the current mood, but exciting things are around the corner – get ready for generative AI to upend financial advisors 🤖; the rise of the expense Super App🦸♀️; and Twitter to make 🌊s as a fintech powerhouse.

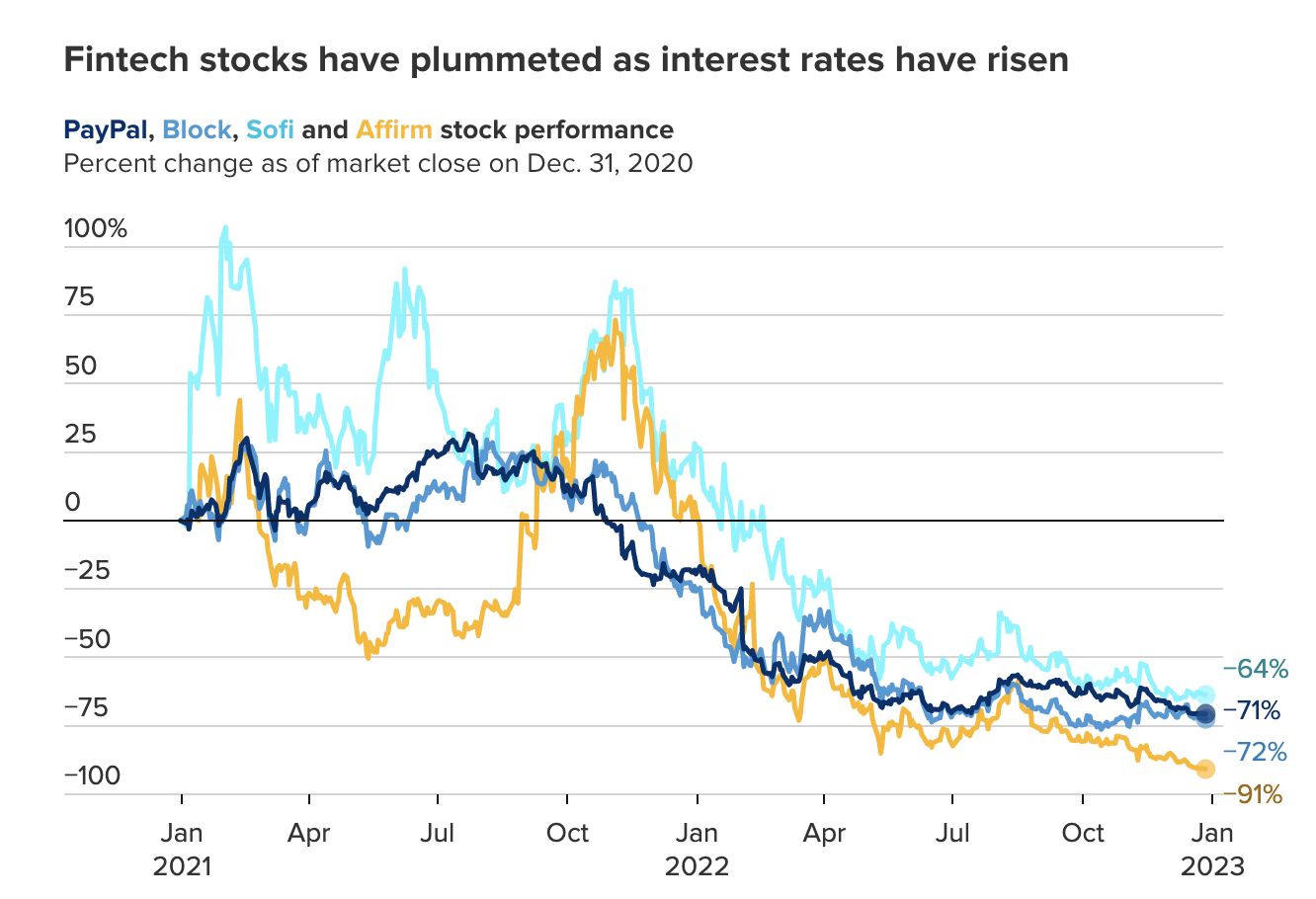

Lots of people are throwing their hands up and saying fintech is uninvestable right now. After a year in which bellwether stocks dropped 70-90%, that sentiment is understandable.

But, it’s a huge mistake.

This is going to be a 🔱Golden Age🔱 for fintech builders and investors. Short term sentiment is brutal, but long term tailwinds are strong.

Here are 5 predictions for where the fintech market goes in 2023:

Prediction #1: Generative AI will upend the $1T wealth management industry.

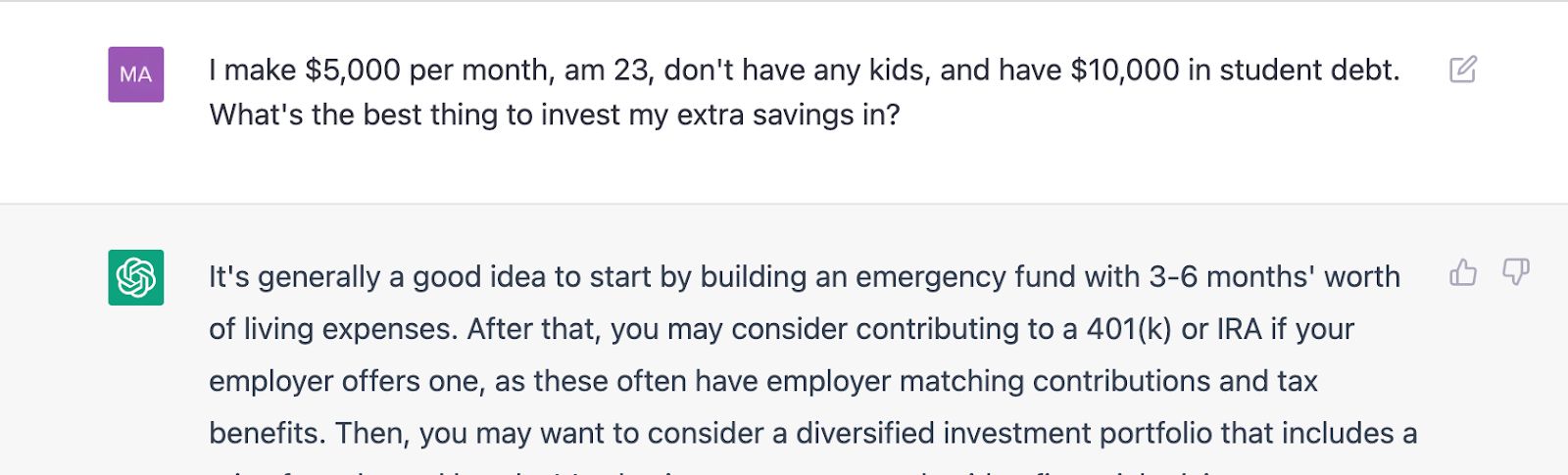

ChatGPT is already a shockingly good advisor today:

Imagine what it will look like when it’s integrated through @plaid into your checking account, payroll, credit cards and savings.

Instead of giving you generic advice, it will be able to offer you personalized recommendations – and then action them automatically.

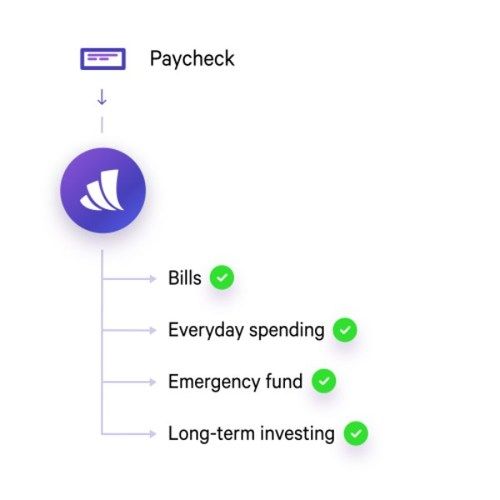

In the future, your paycheck will be optimally routed exactly where you want it.

@Wealthfront pioneered this concept years ago, but generative AI will transform it from a flow chart into Self Driving Money 🚗💵

The Financial Advisor of the future is not a person – it’s a digital co-pilot.

There’s a huge opportunity to use the advances in generative AI and financial APIs to reimagine wealth management and personal finance for millions of people.

Prediction #2: The Rise of the Expense Super App.

It’s not a surprise that revenue has seen a first wave of innovators (Square, Stripe, Adyen and Shopify), and now the expense side of businesses is seeing a tech renaissance.

The one-stop-shop expense tool is coming. Cards, invoices, reimbursements, bank accounts, payroll, travel will live under one roof⛺️

After years of revenue innovators (@Square, @stripe , @Adyen @Shopify) the expense renaissance is here.

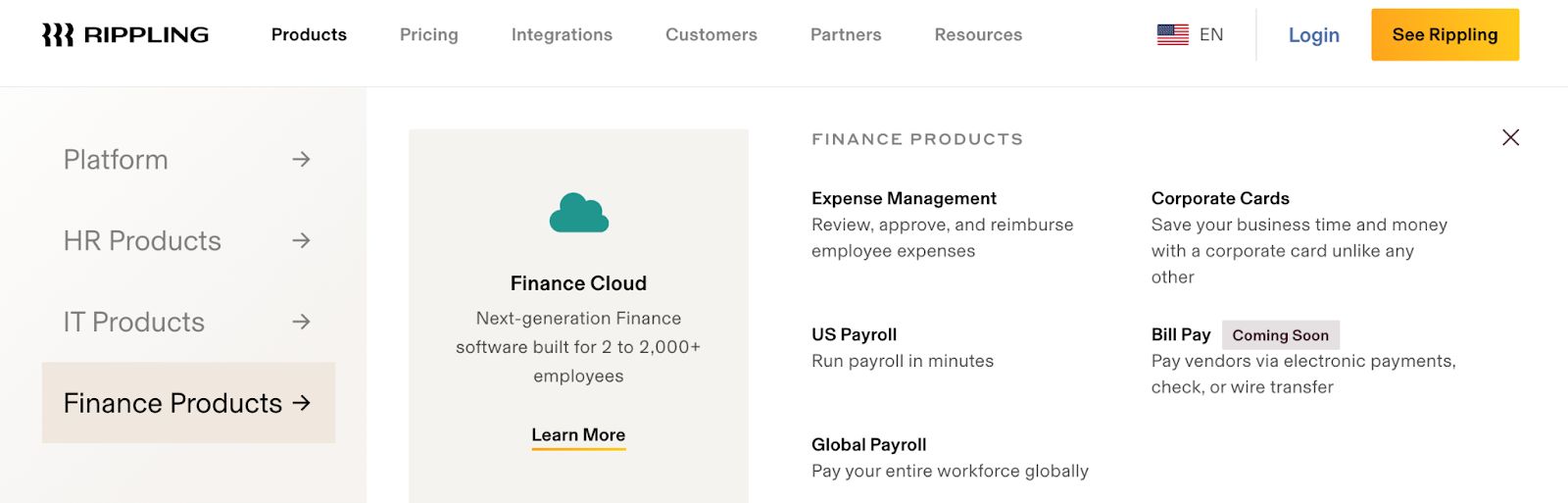

Re-bundling is already here. I was shocked to see someone use a @Rippling credit card the other day (I always thought of them as an HR company) and how they’ve quietly built a significant finance product suite:

The convergence of bill.com, @brexHQ, @tryramp, @TripActions, @Rippling, @deel, @expensify, @remote, @PilotHQ and @mercury will streamline work and make businesses 10x more efficient.

Point solutions will become platforms.

But who will win?

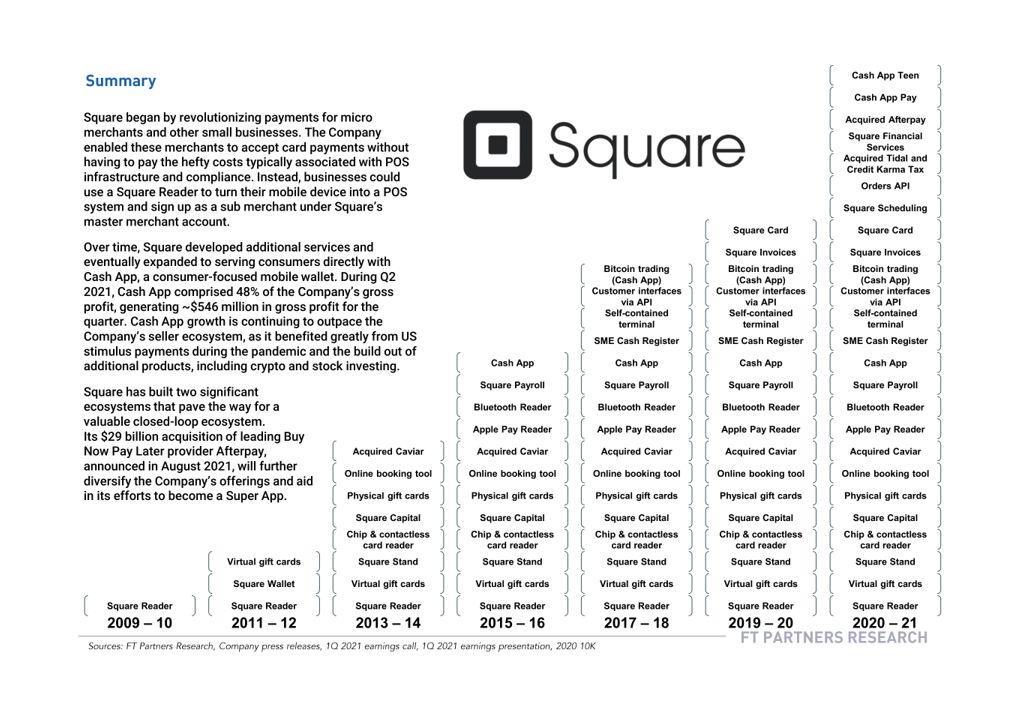

Lots of lessons from consumer finance, where we’ve seen this trend play out – rise to relevance on the back of a killer feature...

- 🧑🎓Sofi = student loans

- 💵Cash App = p2p payments

- 🚲Affirm = BNPL

- 💱Revolut = no forex fees

...then rebundle into a Super App🦹♀️

In a world where features can be copied by competitors, the slope of product growth has been more important than the intercept. 📈

This is why I’m so bullish on Cash App, for example, which I’ve written about in the past:

Product velocity will also determine the winners in the business landscape. Fast-moving founders like @immad @Jobvo @hdubugras @Bouazizalex @parkerconrad @eglyman @waseem are well-positioned.

I expect we’ll see a $100B platform company emerge here in the next 5 years.

Prediction #3: Stripe reopens the IPO market, but at half the valuation of its last private round.

To be clear - I’m extremely bullish on Stripe over the next decade. Why?

- 10x product, where old guard has 80% share of $50T market.

- Legendary Talent Vortex, they've built one of the best hiring brands in tech.

- Platform, revenue drivers abound from new products

But, whether or not they raise more private capital as rumored, there's a lot of reasons to go public.

How will they compare to @Adyen, now trading at ~$50B Euros? @pitdesi compared public data from 2022 here:

Multiples have compressed, and e-commerce growth has slowed. Long term holders will see this as an opportunity; but bears will weigh heavily on the price.

@stripe can kick the can, but I bet they'll be a trailblazer -- we’ll see a successful IPO at a sobering down round.

Prediction #4: Twitter becomes a fintech.

Twitter is in crisis. Regardless of your views on @elonmusk's stewardship, the company needs a Hail Mary to avoid being crushed by its post-acquisition debt load.

Fintech can be the life line that rescues the company.

Twitter, at its core, is a creator platform. But creator monetization largely happens elsewhere. That is a HUGE missed opportunity.

Paid subscribers, tipping & exclusive content would lead to a network of transactions that would tally to a large payments ecosystem.

Elon understands payments. His inner circle understands payments. If the company leans into this, they could build a Paypal for Creators that has a huge impact on Twitter’s bottom line.

The biggest challenge here is simple: trust.

Storing, sending and moving money requires a high degree of confidence in the platform. Twitter has a big hill to climb to restore that 🏔

It’s a long shot, but Twitter could be the surprise fintech winner of the year.

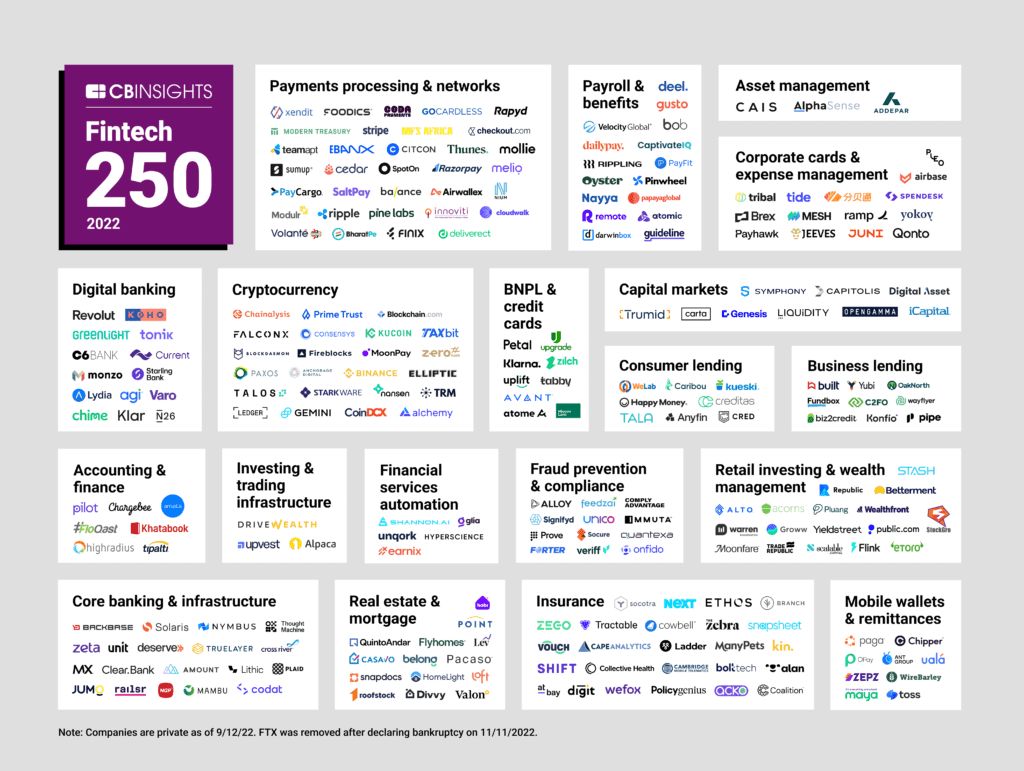

Prediction #5: Consolidation (@CBinsights will be able to use much bigger font next year)

The hype of the last few years created categories bloated with copy-cat business models.

How many API payroll companies do we need? How many lending companies are too many?

2023 is going to be a crucible that puts companies into two buckets: consolidators, and sellers.

In categories where 10 players compete today, 1 or 2 will survive the year.

That’s a hard reality, but a tremendous opportunity for those companies who make it through.

The winners will thrive on the other side of the market downturn.

What resonates? What did I miss? Let me know on Twitter @Mark_Goldberg_

Published — Jan. 30, 2023