Five Fintech Predictions for the Next Decade

2020 brought meaningful shifts to the world of fintech, including the meteoric growth of neobanks, but what can we expect in the next decade? Our partner Mark Goldberg shares five fintech predictions ranging from the rise of fin-fluencers (hint: finance will become cool) to the feature that will define the next chapter of internet history (spoiler alert: it’s Privacy).

Prediction #1: By the end of Biden’s first term, at least one of the neobanks will be worth more than Goldman Sachs.

Goldman Sachs Group Inc. signage is displayed on the floor of the New York Stock Exchange in New York, U.S.

Source: Bloomberg/Getty Images

2020 was a big year for the neobanks (Chime, Robinhood, Revolut, Current, et al) -- signups went through the roof; valuations cracked $10b.

Lots of people think this is overheated...how will they make money? Aren’t they over-valued? How big can they really get?

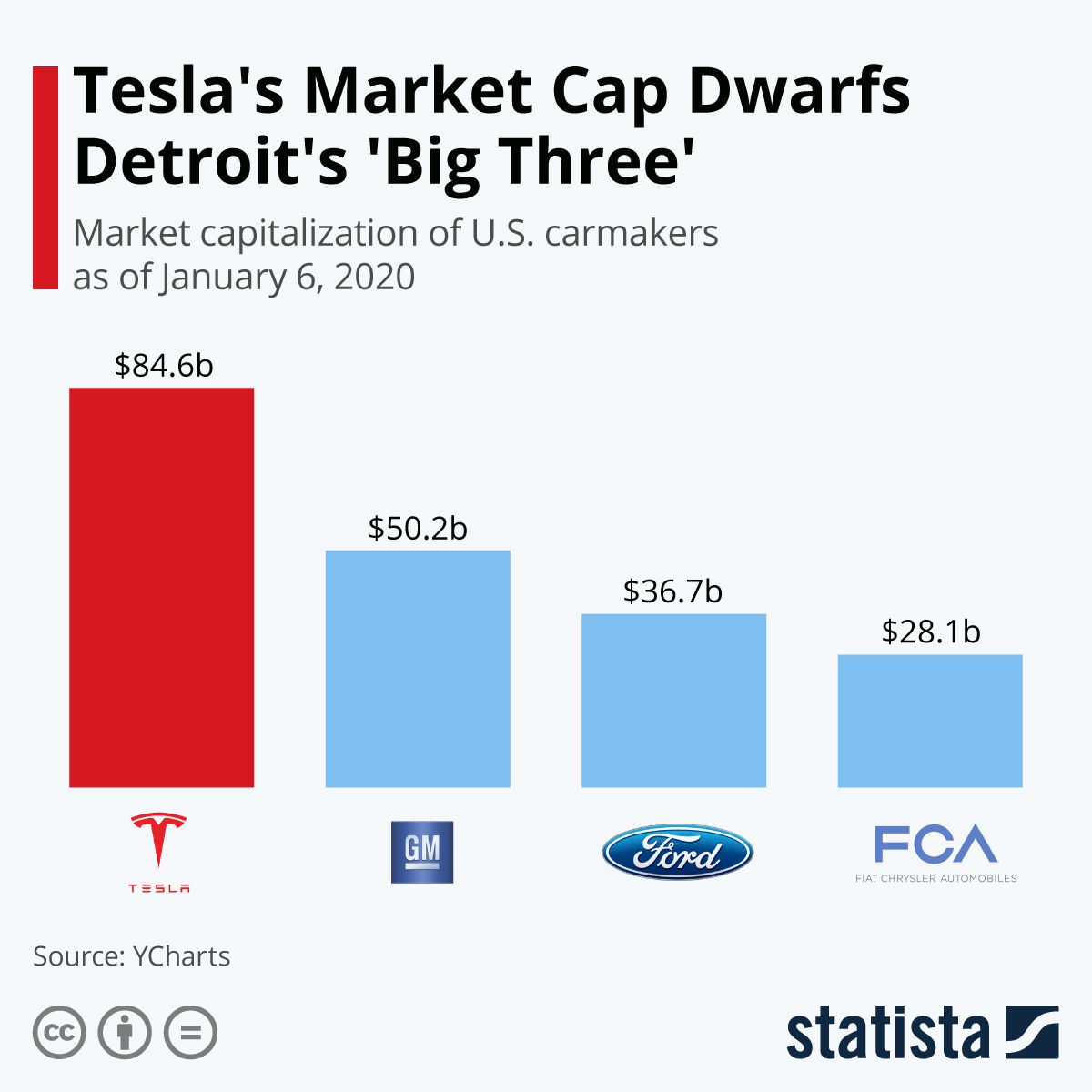

Reminds me of the early days of @Tesla -- a decade ago, people would have thought you were crazy if you correctly anticipated Tesla would be (much) larger than GM, Ford & Fiat Chrysler combined. In the long run, a 10x product wins the market.

The same story is playing out In financial services, and the market is over $1 trillion. People want digitally native & delightful banking products. And they’re sick of incumbents ripping them off with hidden fees and terrible support.

How big can they get?

- <10% of consumers today consider an online bank to be their primary account.

- The 50th largest bank today is worth $50B.

Digital banks are just getting started. We’ll see a neobank eclipse a major incumbent bank in the next few years.

Prediction #2: The rise of multiplayer finance.

Finance is inherently social (trips, meals, events) but money has remained stuck in a single-player paradigm. As the pandemic recedes and social activity explodes, new platforms will put groups, not individuals, at the center.

Source: Android Authority

People have been trying to put ‘social’ in finance for years (remember @SoFi short for Social Finance), but attempts to marry payments with social have largely failed so far — does anyone actually scroll through @venmo activity feed?

One of the most creative shoots I’m seeing emerge from the pandemic is new attempts at collaborative fintech. Startups like @braid_app (whose CEO @amandapey has written extensively about this trend), @public, @YottaSavings) are at the forefront here.

As someone who worked at Dropbox for many years, the obvious analogy is the past decade in software, where collaboration has eaten single-player:

- @NotionHQ -> Microsoft Word

- @figmadesign -> Adobe

- @airtable -> Excel

- @pitch -> PPT

When will we see a ‘Figma for finance’ emerge?

Soon. I can’t wait for the end of lockdowns and I hope some of these products are ready for primetime when we can gather in groups again.

Social payments are just getting started.

Prediction #3: The rise of fin-fluencers.

The future of banking will be as much about brand identity as it is about functionality. Your bank will say as much about you as your clothes, your choice of music, and the car in your driveway.

This is a major departure from the status quo. Most of us feel indifferent to our bank, or just outright dislike it. I’ve never seen people repping bank-branded attire outside of midtown Manhattan happy hours.

But...how about Square Cash’s new clothing line? https://shop.cash.app I don’t know if these clothes are fashionable, or just look that way to me (I have terrible fashion sense), but it speaks droves about where the industry is headed.

Image Credits: Cash App

Finance will become cool.

This is a massive opportunity for new entrants. @fast is already doing this for checkout, with great swag to boot as well (https://fast.co/shop/)

And savvy fintechs are marketing on Snap and TikTok where incumbents look out-of-touch.

Point and case: @Step's rise to the top of the app store on the back of a partnership with TikTok star Charli D’Amelio (and her 100m+ followers). We’ll see a lot more of this in the coming months/years.

Image Credits: Step

Prediction #4: Tech companies, not banks, will offer the best deals on financial products.

As embedded finance makes it easy for any company to become a fintech, tech companies will offer financial products as a loss leader. Consumers will win.

Why does the Amazon Prime card offer you 5% cash-back on Amazon purchases? Because they want you to buy more things, not to maximize profits on their card.

Why is Uber offering cheap/free financial services to employees? To win the driver war against Lyft.

Banks are not structurally capable of replicating this sort of deal because it would cannibalize their most profitable products. Tech companies, on the other hand, don’t need to make money off of financial products because it’s not their core business.

We’re just scratching the surface here -- in the future, your best offer on health insurance may come from Peloton or Apple; your best offer on a loan may come from Patreon. Where will your highest yielding savings account come from? Probably not Chase or Wells Fargo.

Expect doorbuster deals for financial products in a way we’ve never seen before -- just look for them to come from unusual places.

Prediction #5: Privacy will hit the mainstream.

Our financial data is like our search history -- it’s extremely personal. Yet many companies, including credit cards, are packaging and trading our data to the highest bidders with little regard for our privacy.

It’s no surprise that one of the key sales points for the newly launched Apple Card is “Your card, your data.” In the future, privacy will be part of the buying criteria alongside cost and value.

Image Credits: Apple

Why now?

Two and a half decades since the birth of the consumer internet, we are now entering a new era of business in which consumers demand — and expect — a more responsible and transparent approach to the use of personal data and privacy.

Consumers are waking up.

In the coming years, Privacy is how new fintech businesses will build trust and loyalty among their users, and it's the feature that will define the next chapter of internet history.

Note: This is a slightly edited version of @Mark_Goldberg_'s original post on Twitter.

Published — Dec. 22, 2020