Fintech Goes from the Business Section to the Style Section: 2021 is all about the Collision of Finance and Pop Culture

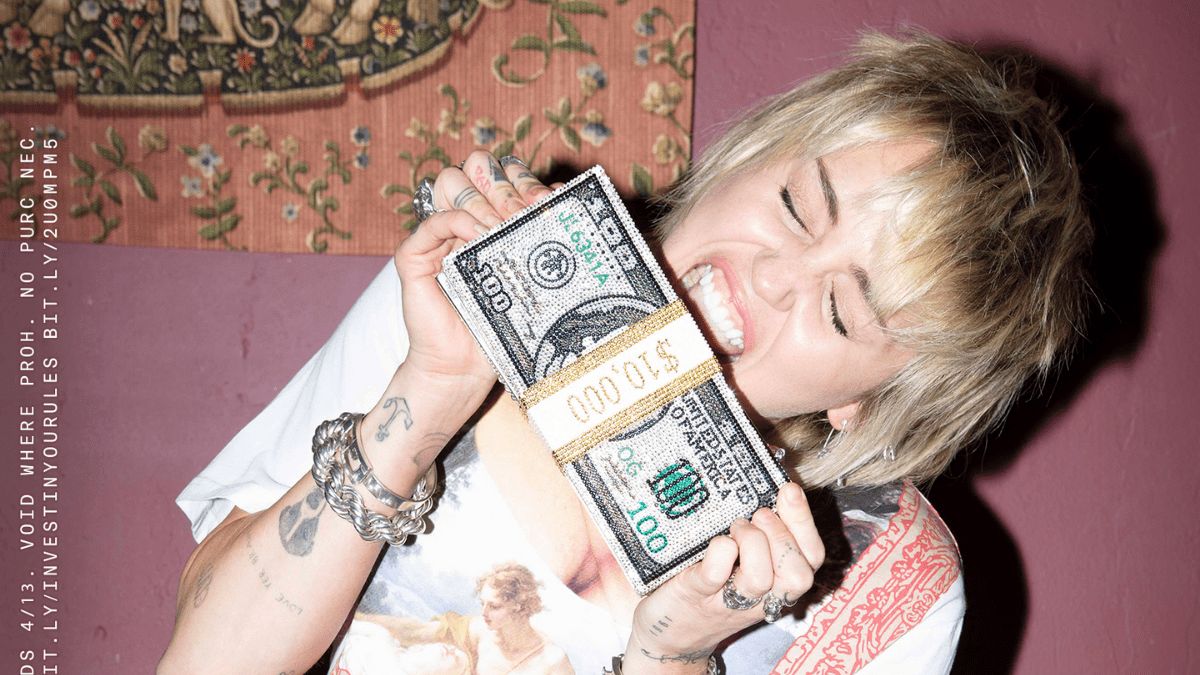

In just a few months, Fintech has gone from the Business Section to the Style Section. How did we go from p2p loans and neobanks to hip-hop culture and Miley Cyrus stock giveaways? Our partner Mark Goldberg unpacks this phenomenon, sharing how the collision of finance and pop culture is re-writing the playbook for fintechs.

Someway, somehow, fintech has emerged in 2021 as a major influence on culture in:

- Art (Beeple’s record-breaking NFT sale at Christie’s)

- Music (Jay-Z on the board of Square)

- Politics (DeepFuckingValue goes to Congress).

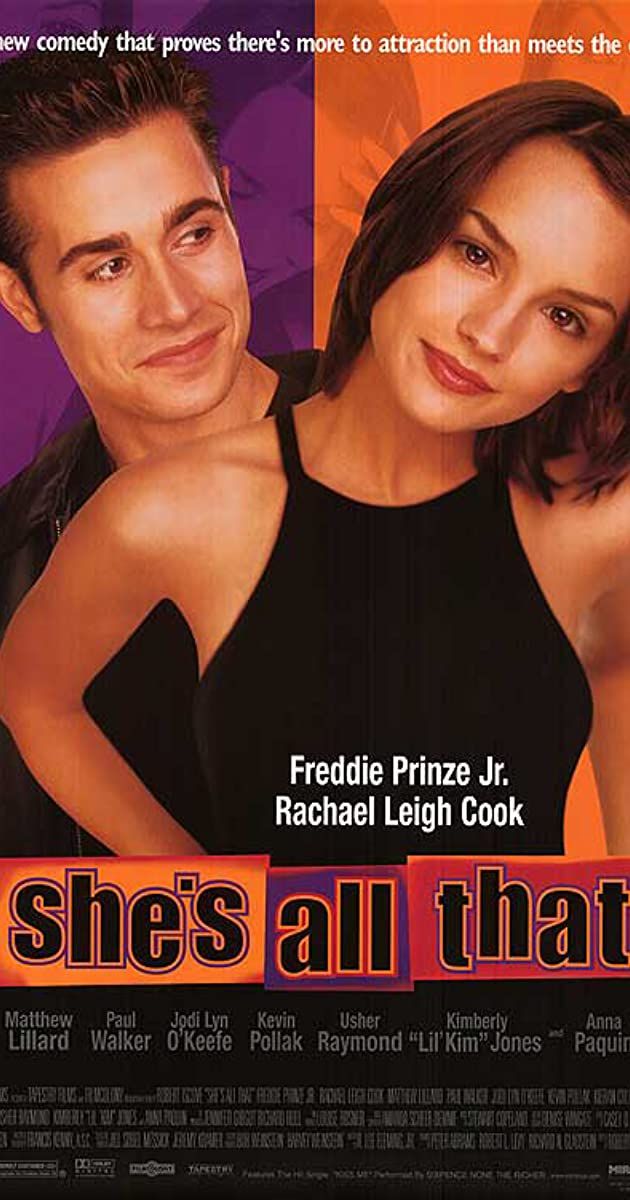

Fintech has gone through a transformation on par with the classic 90s movie She’s All That -- the classic nerd has gone through a glow up to become a Prom Queen contender.

In 2021, fintech is running with the cool crowd.

Why now? Because the battleground for consumer finance has shifted from technology to brand. And pop culture has become the ultimate weapon.

- 1st Wave = Convenience (local bank branch)

- 2nd Wave = Technology (digital products)

- 3rd Wave = Brand (self-expression)

To stand out in 2021, fintechs need to do more than build products.

Take the battle between CashApp and Venmo: Both products are fast and free. Venmo was the first mover. But CashApp used influencers to grow and obliterate its competitor.

Google searches for CashApp vs Venmo in 2015 and Q4 2020, H/T Aika Ussenova

Square is continuing to invest hard into culture:

- Acquisition of Tidal / Jay-Z joining board

- Mentions from 500+ songs on Spotify

- Miley Cyrus stock giveaway

- CashApp clothing store.

The other important change is in how people (esp young people) talk and think about money.

Money is a vehicle of self-expression, not just a store of value.

The explosion of activity in Stonks, NFTs, and Crypto is as much about community as it is about getting rich.

A decade ago, people protested Big Finance with Occupy Wall Street -- this generation is doing it with Gamestop.

Occupy Wall Street

Gamestop

As money becomes a form of identity, influencers & celebrities have built huge followings by discussing it.

Look at how tweets from @elonmusk and @chamath can redefine the value of a stock/coin.

Or a plug from @charlidamelio can boost a fintech in front of rivals.

This means fintech founders need to do a few things differently:

- Lean into culture, not away from it.

- Know your audience.

- Be creative.

The fintechs who embrace culture will not just dominate the landscape, but maybe even find themselves on a red carpet or in a viral video.

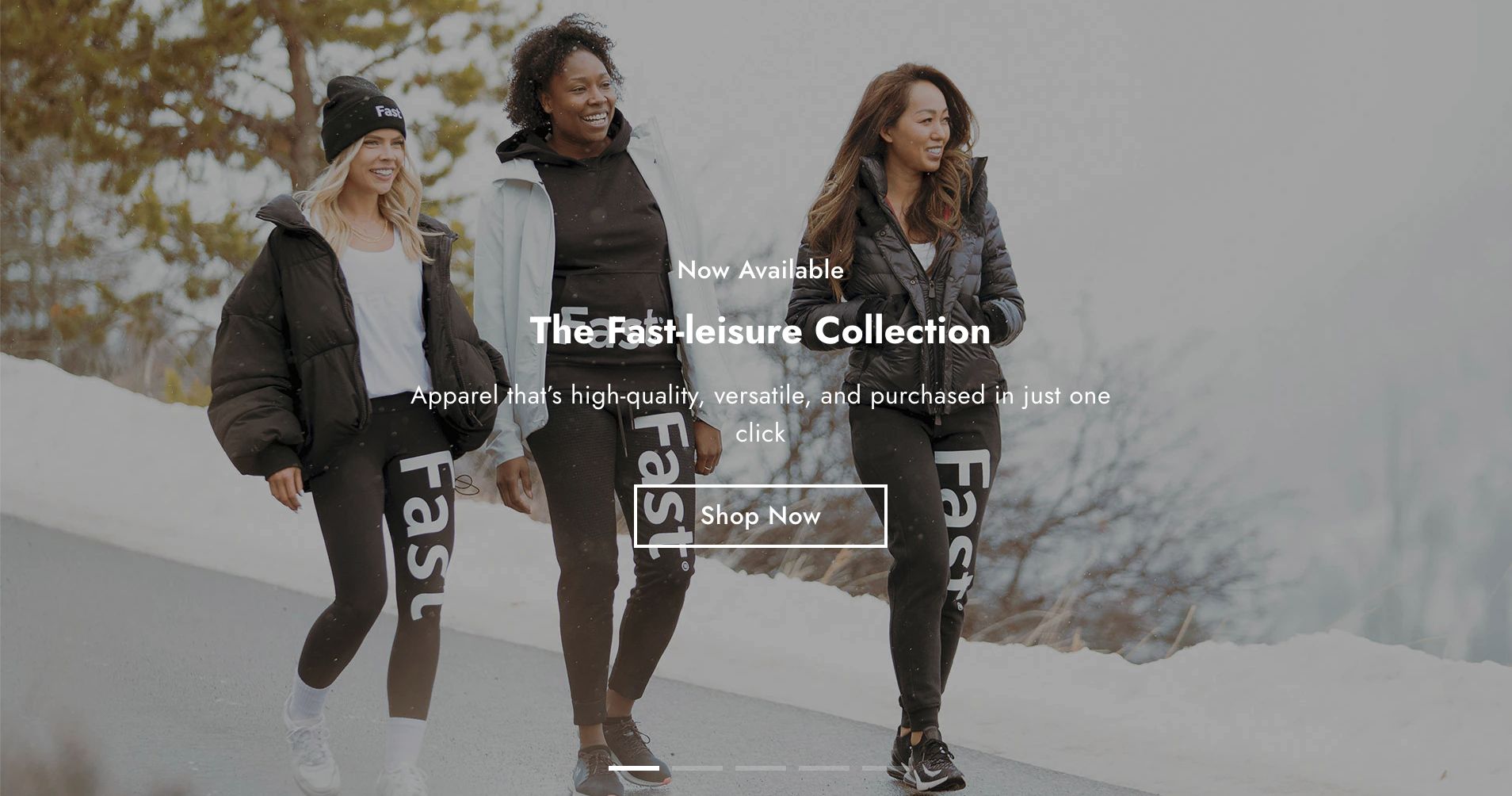

Which fintech’s swag will you be wearing when the lockdown ends and we’re all together again??

The Official Fast Store. Which fintech's swag will you be wearing when the lockdown ends?

Note: This is a slightly edited version of @Mark_Goldberg_'s original post on Twitter.

Published — April 2, 2021