The Crypto Dream is Not Dead. We Hope The Delusions Are

Six months into the crypto meltdown that’s wiped $2 trillion off the market, people are still talking about the chances of a rebound–a ‘crypto spring’ after yet another ‘winter’. What’s surprising is that the correction hasn’t been enough to inject more realism into the discussion. What the carnage actually reveals is that most blockchain-enabled crypto businesses need to be rethought and rebuilt from top to bottom.

Hopefully, our world of speculators will one day be replaced by pragmatists, who can see the blockchain for what it is: a powerful new technology, but not the new internet.

The blockchain has the potential to help shape the future and to power progress and growth–just not in the way it’s typically deployed today. What we’ve witnessed is an industry that often talks of “freedom” and “autonomy”, but just as often tries to use that language to mislead the public. We’ve come across many founders looking to make a quick buck, instead of those willing to commit to the long, multi-year effort that it takes to build real value. We’ve seen people wielding a technology that’s casting around for applications, rather than those trying to solve a real and pressing problem.

When the industry rebuilds, we will hopefully see more genuinely mission-driven blockchain entrepreneurs. In the meantime, it’s important to sift the dreams from the delusions.

The trouble began when people started to talk up the potential of crypto to replace the world’s sovereign currencies, destroy the banks, and totally remove the need for corporate governance via distributed autonomous organizations. The industry was soon flush with money reliant on the success of cryptocurrencies–with many players creating conflicts of interest, artificially increasing the value of the businesses by buying up tokens.

“Community” became one of the most used terms in crypto, but too often it’s a byword for pushing bad investments. We love real communities–but a pyramid scheme is not the same as a network effect. Too many crypto entrepreneurs have been incentivized to talk up, overinflate, and generally “pump and dump” various currencies. Rampant speculation became the biggest affliction.

The current environment is based on token issuers getting rich on day one– equivalent to a startup founder selling a chunk of their company and pocketing it before anything has been built. If you move in crypto circles, you might well have encountered those who’ve cashed out and now loiter in self-satisfied cliques at conferences.

To make it worse, regulators have been slow to act–which is in part why crypto has been so attractive. The sad result is that many people have been ruined by the crypto crash, and no one’s been there to protect them.

The good news is that regulation is coming. Companies using blockchain technology need to focus on creating long-term value with the assumption that the normal laws and rules of finance will apply–from Know Your Customer to Anti-Money-Laundering. Anything that smells off, probably is.

Similarly, crypto businesses can’t sidestep the consequences for the climate of how their tokens are maintained with vast amounts of computing power. Any company that relies on some kind of blockchain can’t avoid talking about its environmental impact and building a responsible business model that takes it into account.

The Ethereum blockchain’s recent switch from a “proof-of-work” process to validate transactions to a “proof-of-stake” one–which reduces its energy consumption by 99.9%–is a step in the right direction, and shows how crypto businesses are capable of reform.

The blockchain can still have a bright future. Lots of us at Index were (and continue to be) intrigued by the technology. We see its possibilities as a medium of exchange–of being able to transfer ownership between two people without a trusted third party–and as a store of value. There is potential in things like open identity verified by cryptographics, the secure transfer of digital assets, the possibility of a verified and transparent record of transactions, and institutional-grade solutions.

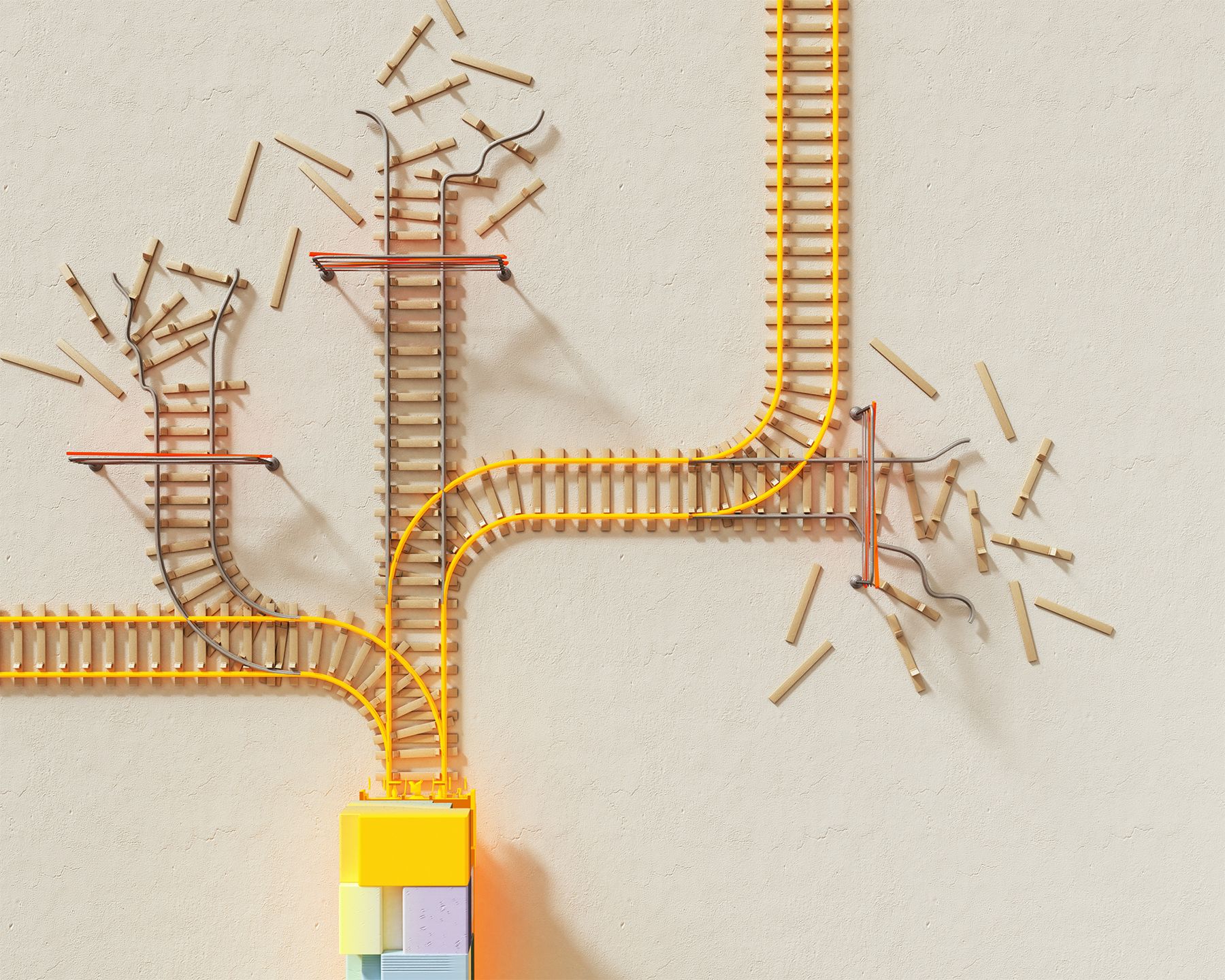

In that spirit, we have and will continue to make investments in blockchain businesses–staying away from startups that make all of their money through short-term trading, gambling, or taking advantage of investors’ credulity. Instead, we’ll back companies that are building the rails for crypto, as well as those leveraging the technology to create better products and services.

It may take a while before more businesses emerge in these areas, but they’re likely to share a few common characteristics. They will offer products and services to a broad set of businesses and consumers, not just crypto natives; they will provide a clear benefit to users, and solve a real pain point; and they will apply blockchain across every sector, rather than creating a sector of their own.

Fundamentally, we’re agnostic about the choice of technology that sits behind a business. What we care about is what someone is doing with that infrastructure. Once some of crypto’s most intriguing use cases become established, nobody will worry whether they’re blockchain-powered or not.

In our view, cryptography is simply an interesting type of technology that can do certain things better–not something that’s going to fundamentally alter the mechanics of our economy and society.

Let’s hope that the present crypto crunch will have a salutary effect in clearing out the many businesses that lack the necessary vision and conviction. There is no doubt that hugely important and influential companies will be built on the back of the blockchain. They just won’t look like most of the businesses kicking around today.

In the meantime, we’ll be cheering on those truly revolutionary founders who want to grab this technology and build something amazing with it.

This article originally appeared on Fortune.com.

Published — Oct. 20, 2022