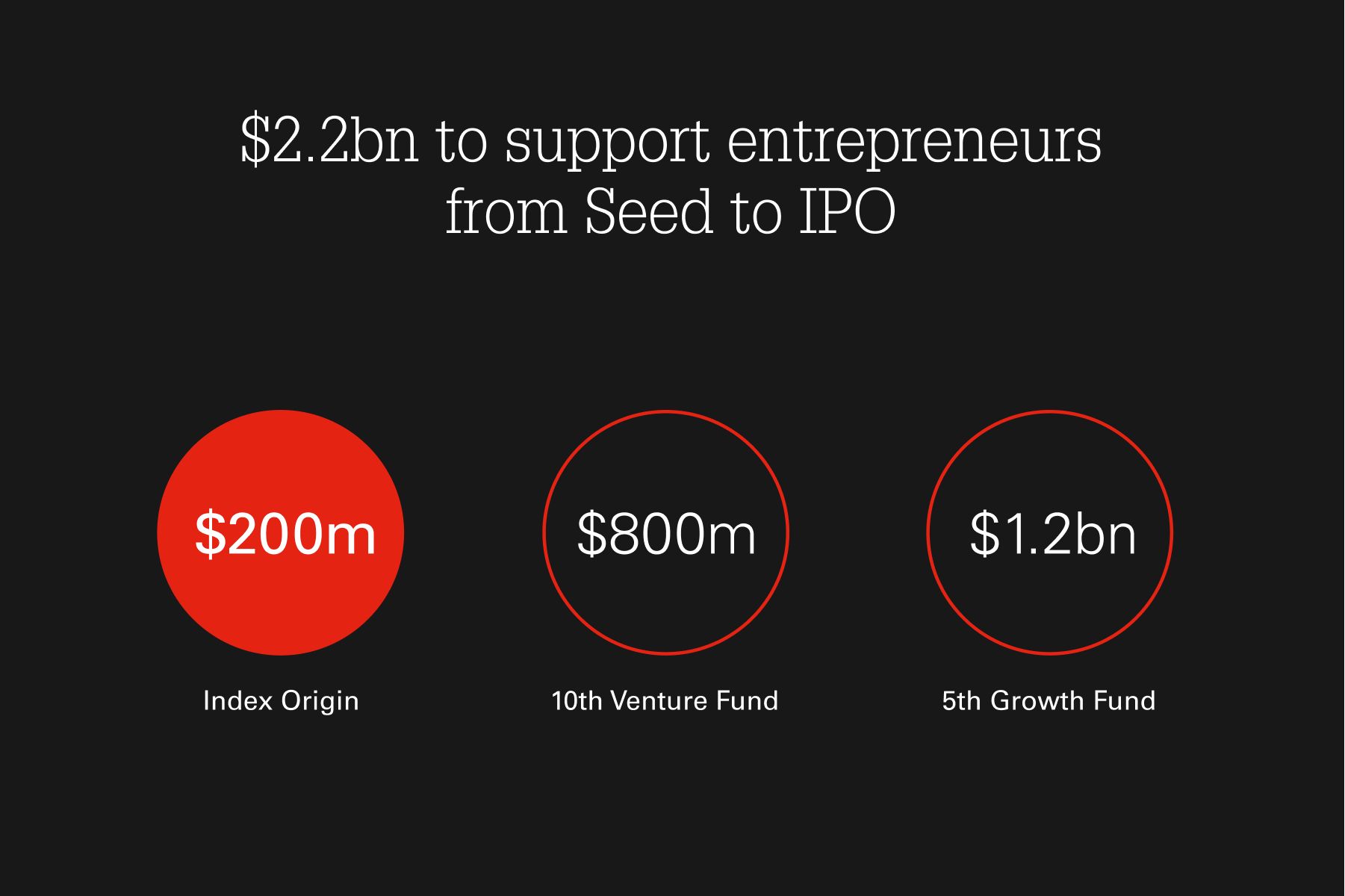

Introducing Index Origin, a $200 Million Seed Fund Investing in Entrepreneurs from Day One

Seed investing has always been the essence of venture capital. It requires the largest leap of faith and the strongest conviction. It demands a razor-sharp evaluation of raw talent and an alignment between founder and investor on what the world looks like in the future.

"Index Origin offers founders the focus and community of a dedicated seed fund, with the resources, network, and reach of a multi-stage global firm. In addition, Index Origin encourages collaboration with the seed ecosystem, including seed funds, solo general partners and angel investors."

— Nina Achadjian, Index Ventures

Over the past year, seed investing has become even more important in the venture ecosystem. More startups are being launched today than ever before, and the race to growing a company has reached record speed. These trends have accelerated the time between raising funding rounds, inevitably changing the rules of early-stage investing.

Today, we’re excited to introduce our new dedicated seed fund, Index Origin. Index Origin offers founders the focus and community of a dedicated seed fund, with the resources, network, and reach of a multi-stage global firm. In addition, Index Origin encourages collaboration with the seed ecosystem, including seed funds, solo general partners and angel investors.

Q&A with Nina Achadjian, Partner at Index Ventures, on Index Origin.

Is seed investing new to Index?

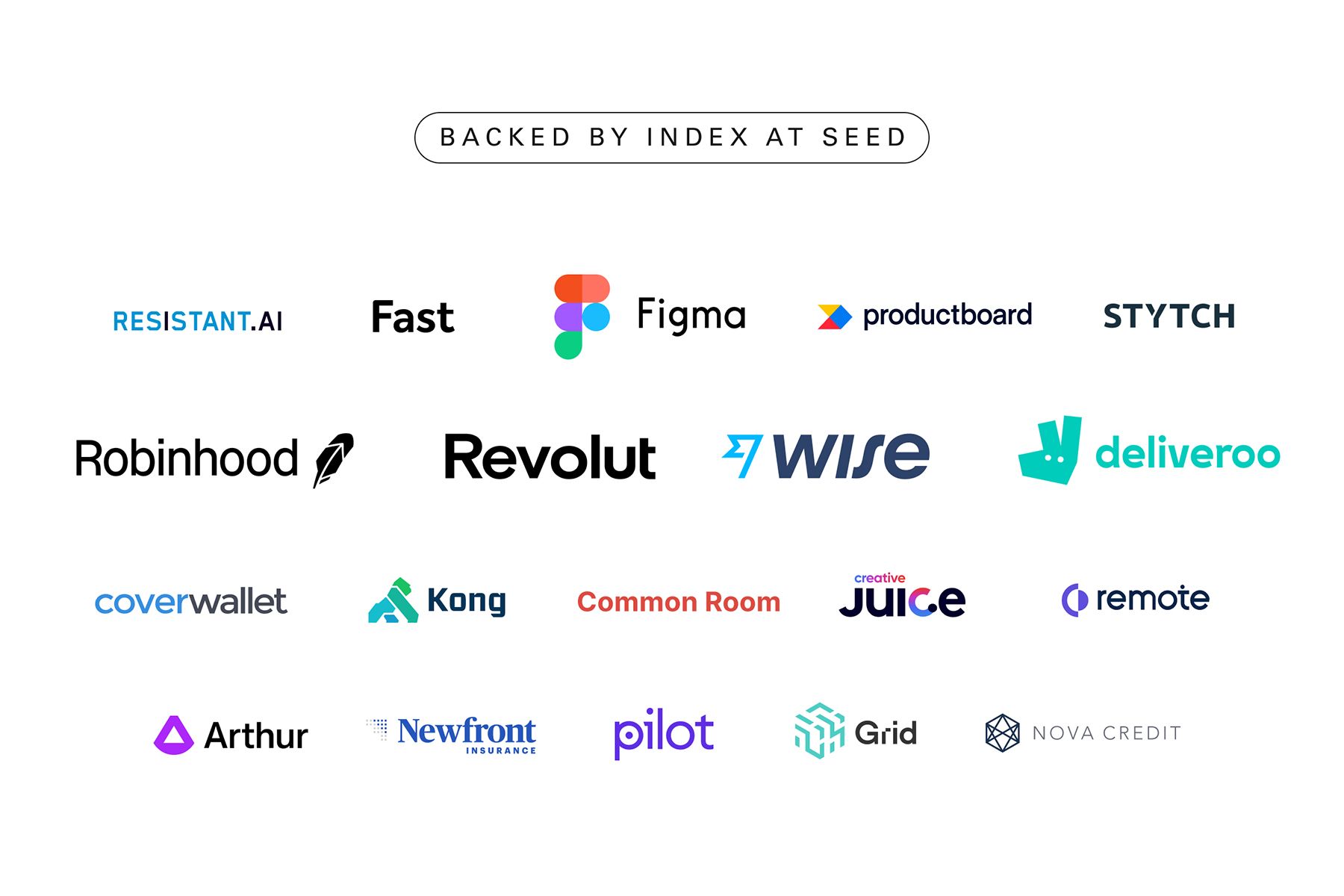

Embarking on long journeys with entrepreneurs from seed to long-term success is often the most rewarding type of partnership. From the early days of Index Ventures, we have supported entrepreneurs from day one. We backed Baiju and Vlad at Robinhood before they secured their securities license. We bet on Will at Deliveroo when the company was operating in a handful of London neighborhoods, and we supported Taavet and Kristo at Wise (formerly known as TransferWise) after their debut pitch at Seedcamp demo day. Seed investing is rooted in our origin, so to speak.

Robinhood co-founders Baiju Bhatt and Vlad Tenev. Backed by Index before they secured their securities license.

Deliveroo founder Will Shu. Backed by Index when the company was operating in a handful of London neighborhoods.

Wise (formerly known as Transferwise) co-founders Kristo Käärmann and Taavet Hinrikus. Backed by Index after their debut pitch at Seedcamp demo day.

Why launch a dedicated seed fund now?

There’s never been a better time to start a company. Our behaviors as consumers and workers are changing and even the most archaic industries are realizing they need to run their businesses with the latest, state-of-the-art technology. It is therefore no surprise that there are more companies being started today than ever before.

Moreover, the speed of building a company has skyrocketed. Founders must grow their companies faster than ever before to capture the market opportunity before a competitor shows up. In turn, they require more resources earlier in the business lifecycle to spend on marketing, talent, and tools. This means compressed fundraising timelines between seed and Series A.

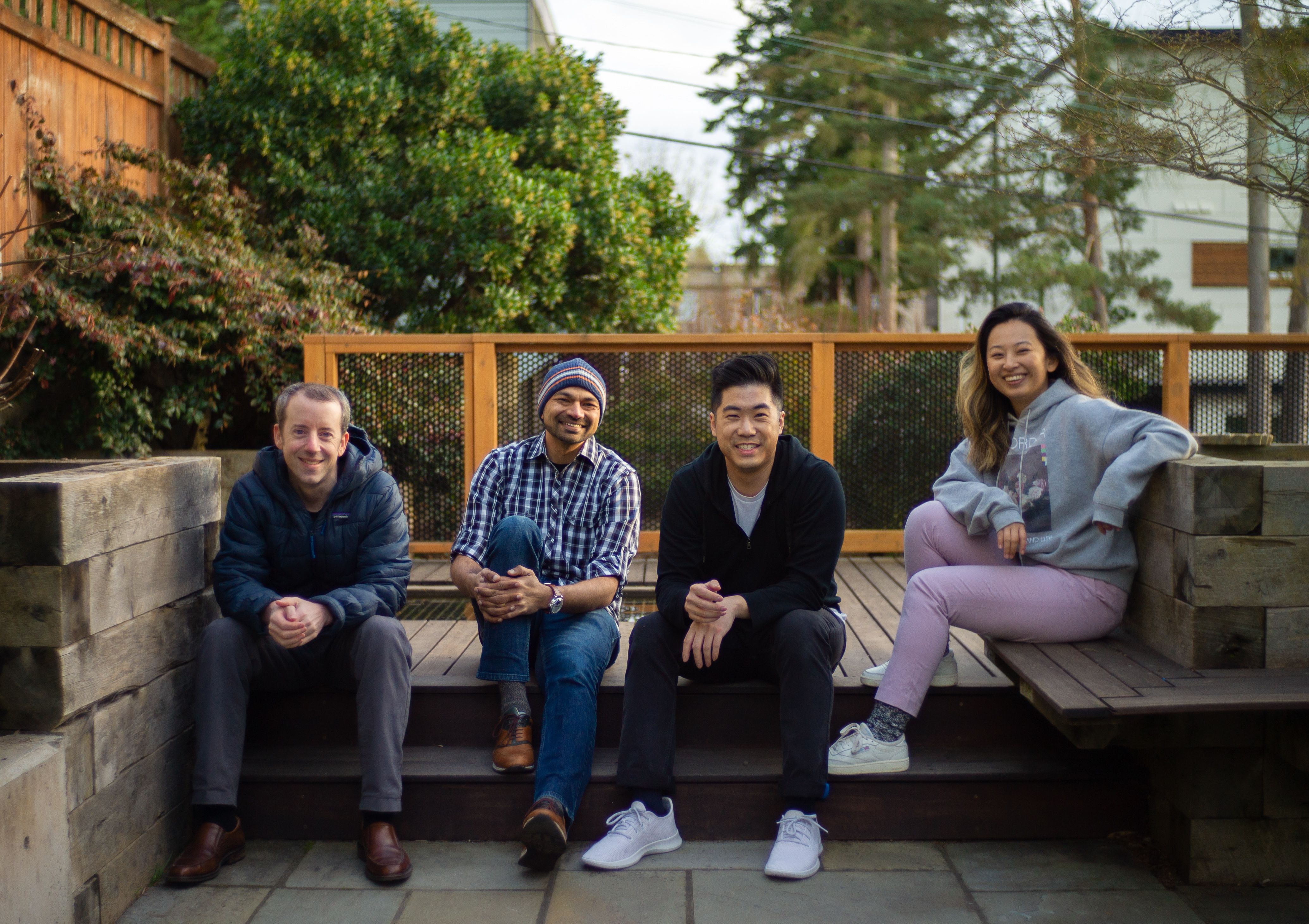

Consider Common Room, a community management company founded in January 2020. The startup raised its seed round after just three months and its Series A after nine. Earlier this month, they announced a $32 million Series B round—just 15 months after starting.

The Common Room founding team (from left to right) Tom Kleinpeter, Viraj Mody, Francis Luu, and Linda Lian. The startup raised its seed round after just three months and its Series A after nine. Earlier this month, they announced a $32 million Series B round—just 15 months after starting.

Common Room isn’t an outlier. Many of today’s founders find themselves thinking about raising a Series A mere months after their seed.

When raising their seed round, founders have historically had to choose between dedicated seed funds and multi-stage funds. Seed funds have incredible knowledge and domain expertise but typically only invest in the first few rounds of a company. Meanwhile, multi-stage funds have access to resources and a bigger network, but they lack the intimate knowledge and expertise of early-stage challenges and opportunities. We believe there hasn’t been the right product in the market to help founders have the best of both worlds and that was our inspiration for Index Origin.

What does Index Origin offer to seed-stage founders?

Through Index Origin, we aim to give founders a platform that scales with them from origin to IPO. This means we’ve built seed-specific resources to give them the support they need and meet them where they are. In addition, we encourage collaboration with the broader seed ecosystem and often will co-invest with seed funds, solo general partners and angel investors.

What seed programs does Index Origin offer?

- First Hires: In the early days of a business, getting the team right is crucial. Index Origin’s recruiting team will partner with founders to think through strategies for recruiting and hiring early employees.

- Early Adopters: Index Origin will help founders gain access to key decision-makers at well-known companies, with the opportunity to become design partners and help startups with early customer feedback.

- Operating Experts: Over the last 25 years, Index has built an extensive network of specialists, experts, and authorities across product, sales, finance, operations, and engineering. Founders will have access to this network for help with specific advice or guidance.

How does Index Origin work with seed funds?

According to a recent survey we conducted of our own founders, 65 percent said they would prefer to raise from a combination of seed and multi-stage funds.

We know it takes a village to build an iconic company. That’s why we are taking a collaborative approach and embracing the seed community. We are prioritizing co-investing with seed funds, solo general partners, and angel investors for the benefit of our founders. According to a recent survey we conducted of our own founders, 65 percent said they would prefer to raise from a combination of seed and multi-stage funds. Those who strictly focus on seed are best-in-class at what they do. They have the expertise, passion, and a sixth sense for spotting industry trends. Bringing these organizations around the table isn’t just a source of strength; it’s something founders have wanted for a long time now.

How early will Index invest at seed?

There’s no such thing as “too early” at Index. Dylan Field was a 20-year-old intern at Flipboard when he pitched Figma to Index. Our partner, Danny Rimer, recalls the “remarkable combination of humility and laser focus” he brought to the meeting and led the seed round on the spot. Today, Figma is the most used platform companies use to create, test, and ship better designs from start to finish.

Figma CEO & Co-founder Dylan Field. Dylan first pitched Index Ventures as a 20-year-old intern at Flipboard.

In the last 18 months, Index has done nearly 40 seed investments, including companies such as Fast, Goody, Grid, Remote.com, Resistant AI, and Stytch.

We’ve been incredibly fortunate to work with amazing founders, each with a unique background. Whether it is domain expertise, an incredible knack for hiring, or a new perspective, the founders we partner with come from all different life experiences and skills.

What geographies will Index origin span?

Talent and ideas exist everywhere. We have backed entrepreneurs all over the world, although we tend to have a greater focus in the U.S. and Europe.

With the launch of a dedicated transatlantic seed fund, we have increased the amount of capital available to seed-stage startups, offered tailored support and counsel, and—in partnership with seed investors—provided entrepreneurs the best chance at success.

Published — April 8, 2021