Metrics That Matter – Three Practical Observations on Valuation

As part of Metrics That Matter, we’ve written about three analyses to track on the path to profitability and two metrics to calibrate retention and expansion. These metrics serve as both outputs and inputs. They are outputs from activities of people at companies working hard to create compelling products, distribute them to customers, and drive the business forward. They are also inputs to valuation, a topic especially pertinent in today’s market.

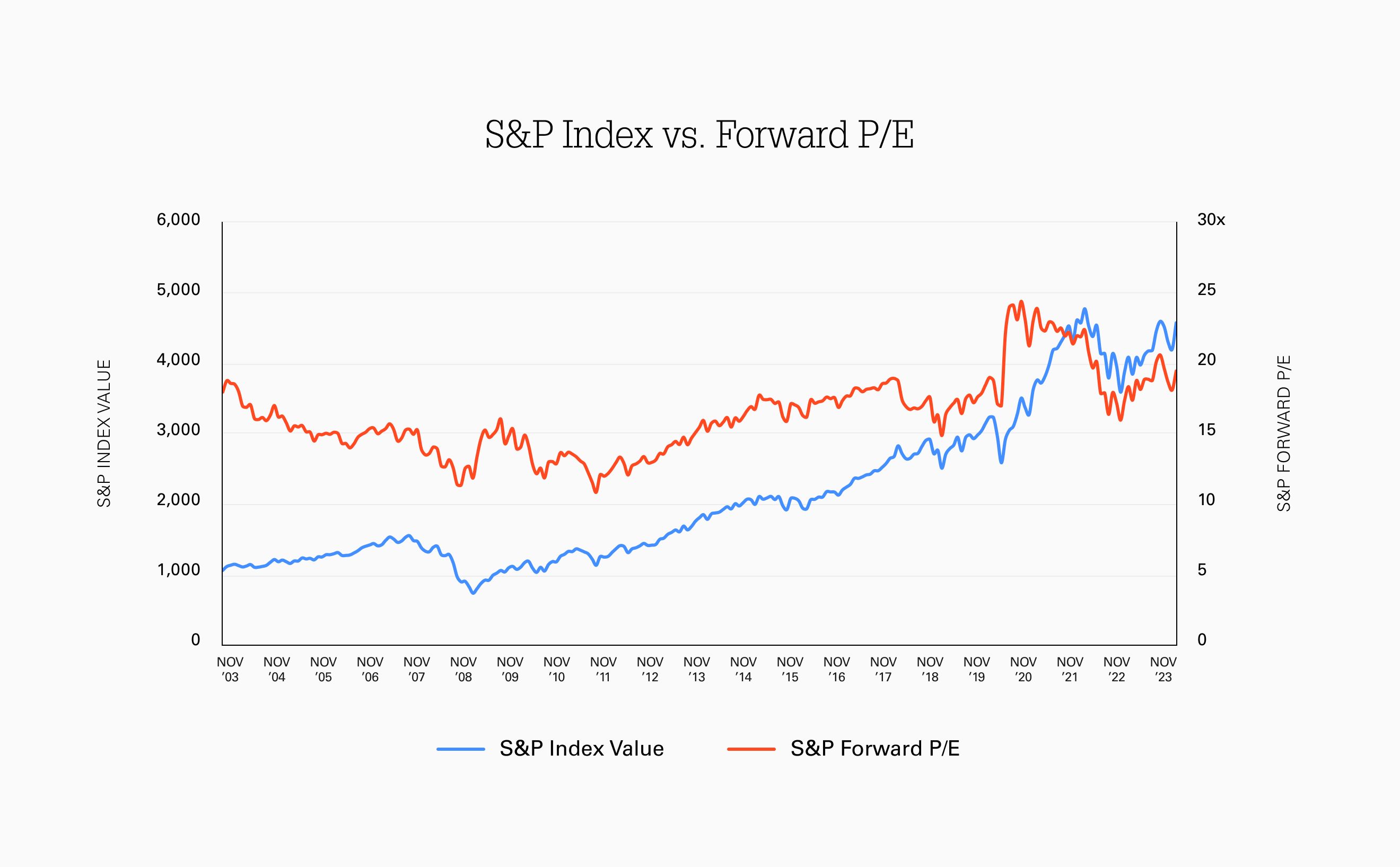

We are fast approaching the two year anniversary of an all-time high for the S&P in January 2022. After a tumultuous 2022 and 2023, the S&P rallied in November and is now re-approaching the high, with valuation multiples also coming back due in part to the rise of the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) as well as investor optimism around the potential for interest rate cuts.

Given the whiplash, founders, operators, investors, and analysts alike are left wondering how to think through valuation.

Over the years there has been some widely praised and well-researched literature on valuation but these guides can be hundreds or thousands of pages, often leaving readers overwhelmed.

With that in mind, three practical observations on valuation for founders:

- Interest rates govern public and private company valuations

- Focus on durable, high quality revenue growth

- Valuation is driven by sentiment in the short-term and fundamentals in the long-term

Interest rates govern public and private company valuations

High performance coaches recommend clients “control the controllables.” Unfortunately, interest rates are not one of those controllables.

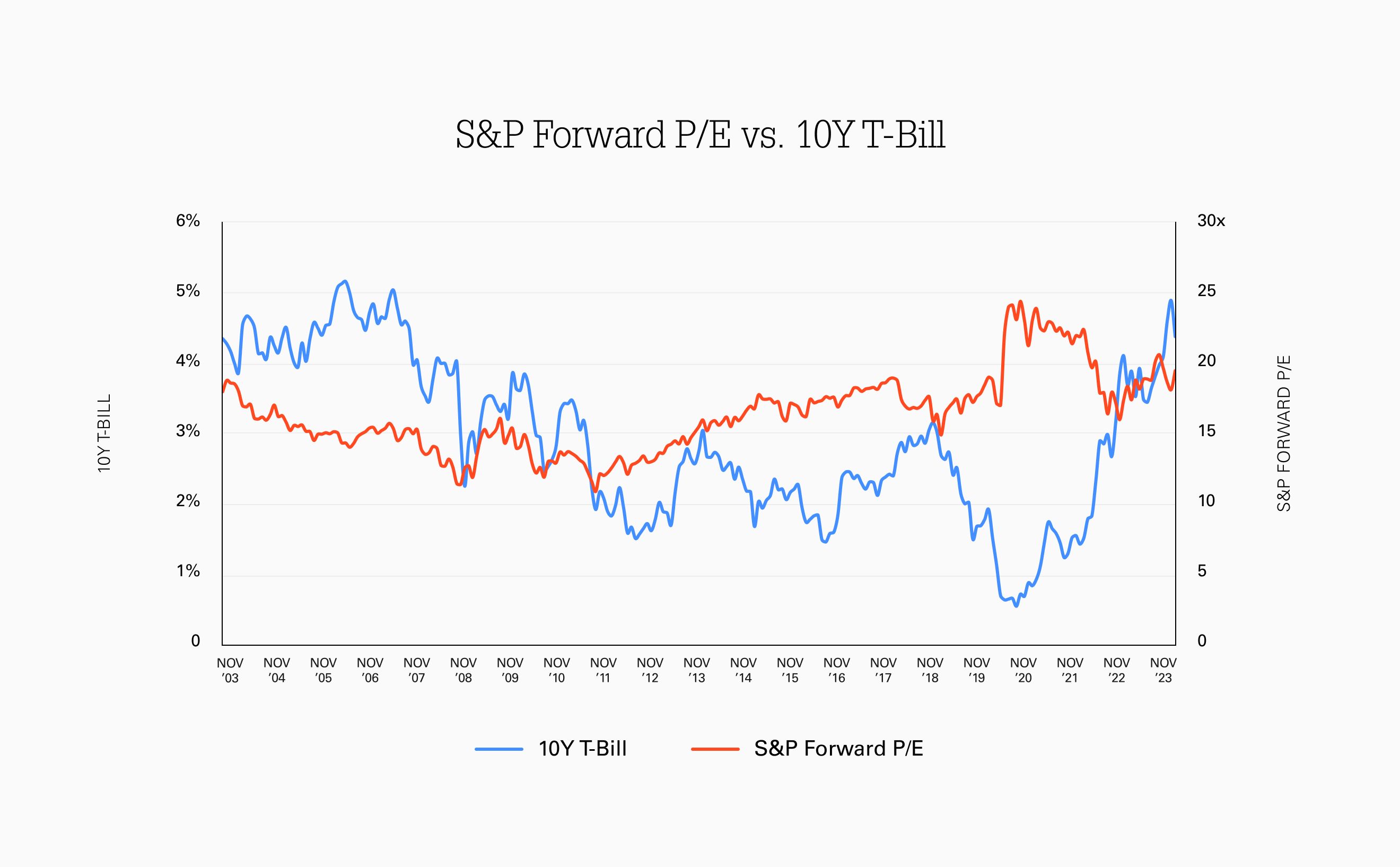

The Federal Reserve sets monetary policy as a way to achieve low and stable inflation in the price of goods and services. When the Fed increases rates, it becomes more attractive for individuals to save at depository institutions rather than spend. The same is true for investors. If it’s more advantageous to invest in risk-free government bonds, investors expect higher returns to invest in risk-bearing stocks.

When it comes to valuation, the public market typically talks over time about multiples of earnings, meaning net income or profit. For example, a price to earnings (P/E) multiple of 20 means that a company with $1 of earnings per share is valued at $20. A 20x P/E multiple implies a 5% earnings yield (1/20). If a company does not yet have earnings, analysts will refer to other proxies for earnings such as revenues, gross profit, or EBITDA.

When interest rates increase, multiples decrease because investors demand a higher yield to invest in equities rather than bonds. We can see this by plotting the 10Y treasury bill rate against the S&P forward P/E multiple.

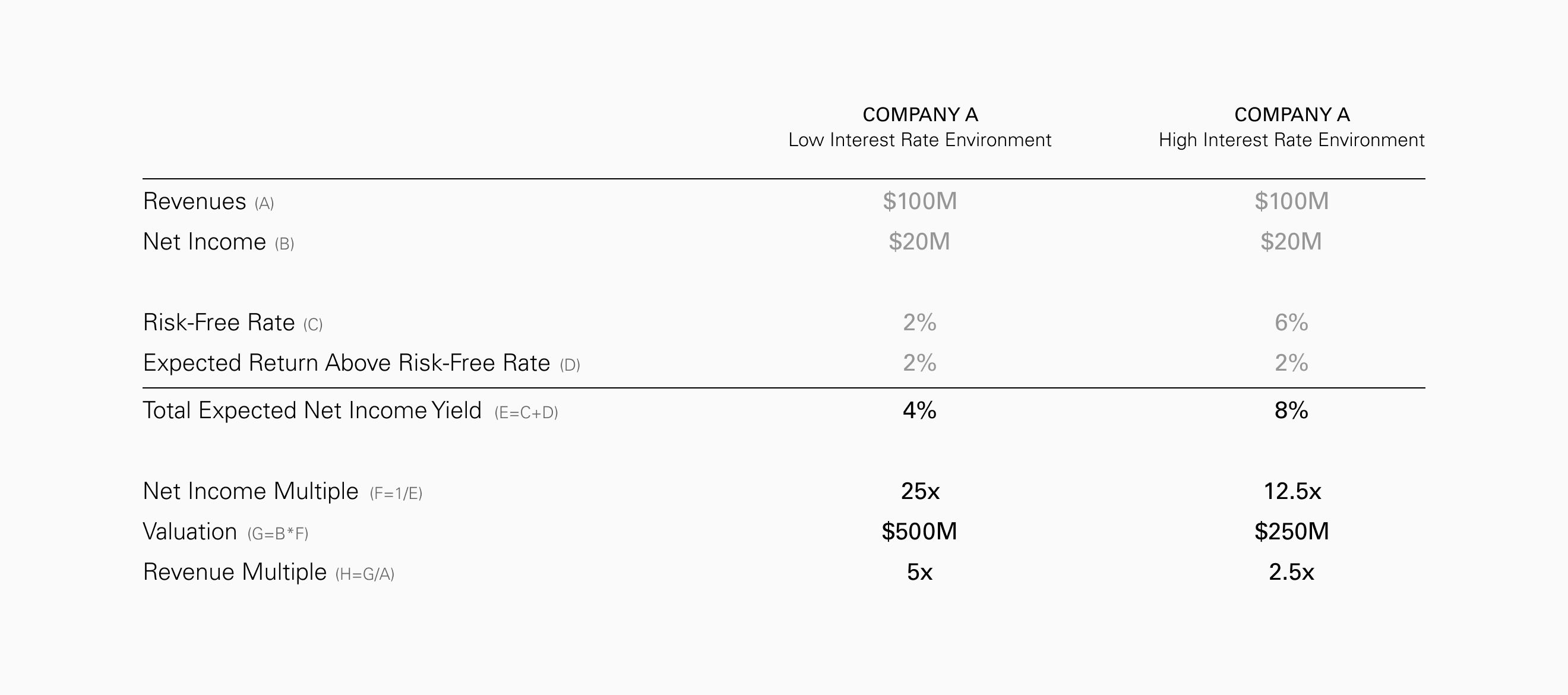

It’s not always intuitive, but a small change in interest rate can greatly impact valuation.

Take a company making $100 of revenues and $20 of net income. In a 2% interest rate environment, an investor expecting to earn a 4% net income yield (the risk-free rate plus a bit extra to compensate for risk) might value the company at $500, or 5x revenues. In a 6% interest rate environment, an investor expecting to have an 8% net income yield might value that same company at $250, or 2.5x revenues.

When interest rates change course, valuations can shift rapidly as shares of public companies are traded daily with price impacted by supply and demand. When public market valuations are impacted for a prolonged period, private market valuations typically follow. As a result, movements in interest rates cascade throughout the capital markets.

While it’s not possible for startup founders to influence interest rates, there are other controllables regardless of whether interest rates are high or low.

Focus on durable, high quality revenue growth

Though the market talks about valuation in terms of multiples of earnings or revenues, these multiples are short-hand for a discounted cash flow analysis which says that a company should be valued as the sum of its future earnings discounted back to the present day.

In the early stages, proving product market fit is critical. At the growth stage, durable high quality revenue growth is what will ensure a strong valuation.

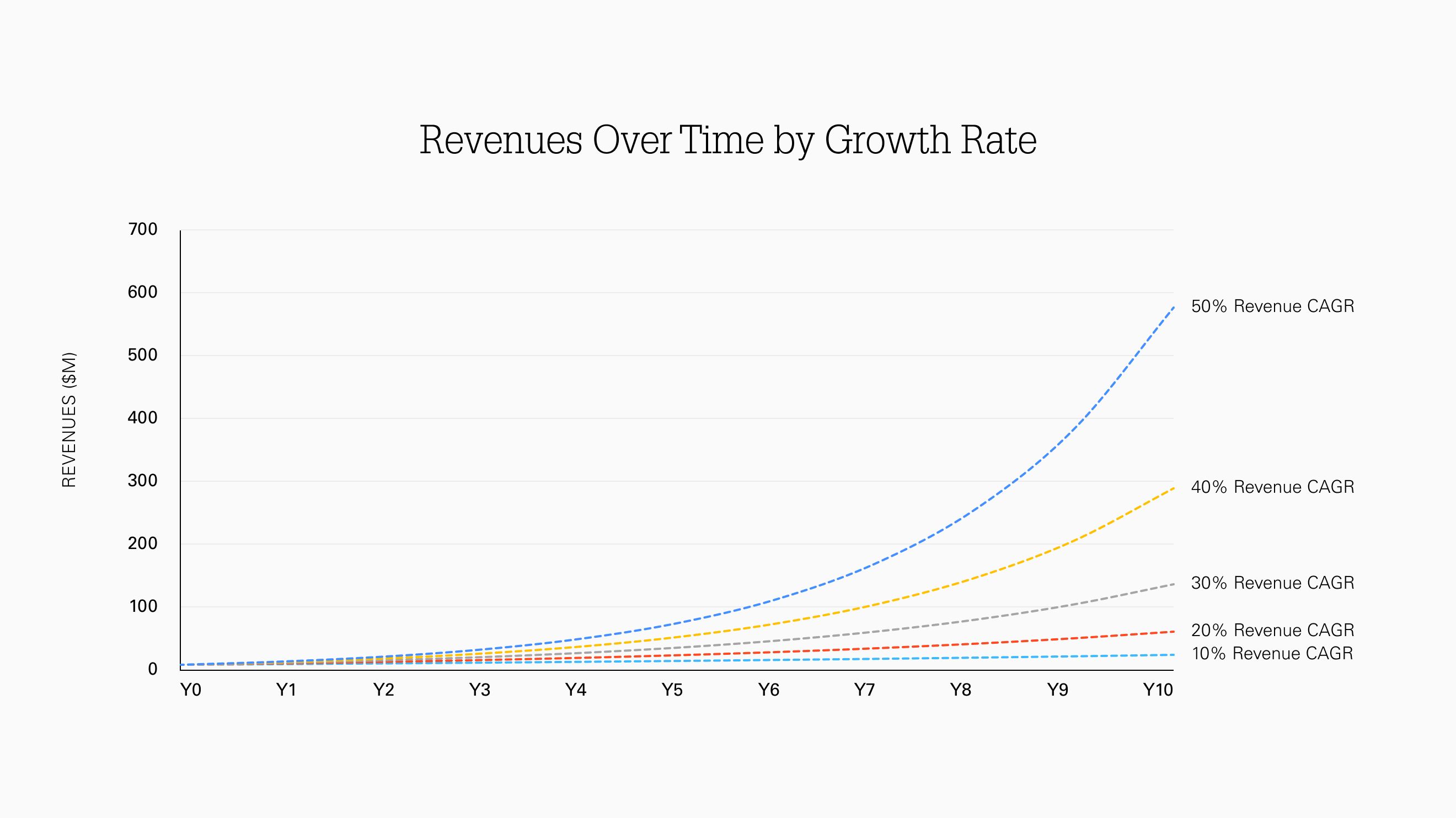

Some have referred to compounding as the “8th wonder of the world” and it’s no surprise why. Take two companies starting at $10M of revenues. The one which grows at a 50% rate (Company A) will end up at over $250M in eight years whereas the one which grows at 30% per year (Company B) will end up at roughly $80M during the same time period. The longer you extend the time frame, the further the gap widens:

Company A should have a higher valuation today than Company B even though they are both at $10M of revenues, assuming they will have roughly similar margin structures. Companies which are able to durably compound revenues over a long period of time mathematically should have higher valuations today than counterparts which can’t.

During tumultuous macro environments it’s important to hone in on the micro and ask simple questions on durability of your revenue growth:

- Does my market have a large number of potential customers to serve?

- Does my company offer a differentiated and compelling product?

- Do customers gain strong utility and a measurable return when they use my product?

- Is my product retentive, with sticky end-user behaviors?

- Does my pricing and packaging allow for expansive customer relationships?

- Are there cross-sell opportunities with existing customers?

- Are there opportunities to efficiently acquire new customers?

These attributes will eventually flow through to valuation in the fullness of time.

Valuation is driven by sentiment in the short-term and fundamentals in the long-term

In the short-term, valuation is set by supply and demand for shares. In the public markets prices can fluctuate wildly depending on prevailing market sentiment that day or even that hour. While private company shares are not traded daily, rounds are priced based on sentiment about future growth.

In the long-term, companies must have strong fundamentals to maintain premium valuations. Beyond durable revenue growth, this means maintaining high returns on invested capital.

"During times of uncertainty, discipline, prioritization, and patience are key."

— Paris Heymann, Index Ventures

Restaurant chains offer a good analogy. A local burger joint with 10 locations will be valued much higher today if investors believe it has potential to expand to 100 locations over time, with attractive returns to open each new location. In the short-term valuation will be set by sentiment or expectations about the future, but in the long-term the chain will have to make good on its expansion plan or the valuation multiple could contract meaningfully.

Technology companies act similarly. To maintain attractive multiples, they must grow and with strong rates of return on their internal investments. B2C tech companies should be able to predictably acquire customer cohorts which behave similarly over time, with clearly defined and attractive ROI whereas B2B tech companies should be able to invest in hiring incremental salespeople who bring in new customers.

Companies compounding revenues at a high rate and with strong returns on invested capital tend to earn above-market valuations even during high interest rate environments.

In any interest rate environment, it’s essential to extend your time horizon and focus on long-term value creation as opposed to short-term wins. Your company’s terminal growth rate, margin structure, earnings potential, and return on invested capital will drive fundamental valuation over time through macroeconomic cycles. During times of uncertainty, discipline, prioritization, and patience are key.

THIS PIECE WAS ORIGINALLY PUBLISHED IN TECHCRUNCH.

Published — Dec. 5, 2023