Index launches OptionPlan Seed – the free app to help all seed-stage founders design competitive stock option plans

Startups’ ability to attract and retain top talent is the most critical factor to their success. This is true at every stage of the business, but especially important at seed, when the foundations of the company are being built. It’s also the time when cash is most constrained, and startups are unable to match the high salaries that many roles in tech command. This makes stock options in the business absolutely essential to convincing candidates to join (and helping to retain them as the company grows).

However, designing a competitive stock option plan isn’t always straightforward. Today, we aim to make that a bit easier, with the launch of OptionPlan Seed, a web-app for seed-stage founders designing ESOPs (Employee Stock Ownership Plans).

OptionPlan is based on the most extensive analysis ever of seed-stage option grants, with data from over 1,600 startups. It also:

- Covers every role in your team;

- Provides 6 different levels of allocation benchmarks;

- Calculates potential financial upside for each team member (including tax);

- Adjusts according to policy frameworks in the US, Canada, Israel, Australia and 20 European countries.

OptionPlan Seed builds on the OptionPlan for Series A companies that we launched a few years ago, and which has since been used by thousands of companies.

We developed OptionPlan and the supporting resources to assist founders of the many seed and Series A companies Index backs. In fact, 75% of our initial investments have been at Seed or Series A, including Robinhood, Figma, Deliveroo and Revolut. Earlier this year, we launched Index Origin, a $200m dedicated seed fund.

Our approach to seed investing is a highly collaborative one, based on co-investing with the world’s leading seed funds, solo general partners, and super angels. This ensures founders in the Index family benefit from a broad range of support and expert advice in the early stages. In that spirit, we’re making OptionPlan Seed available for everyone to use, and welcome your feedback on how we can continue to improve it.

In our research and development of OptionPlan Seed, we’ve discovered that compensation at seed-stage has shifted dramatically in the past few years. Here are some of the key findings:

(Almost) all seed-stage employees receive stock options

In the US, 97% of technical hires at seed stage startups receive stock options, while 80% of junior non-technical hires receive them.

In Europe, 75% of technical hires receive options, dropping to 60% for junior non-technical hires. Whilst we don’t have comparative data for 2018, our sense is that this represents a significant increase in the prevalence of stock options in Europe. This is something that we at Index have been promoting passionately for several years now as part of our policy initiative Not Optional. We see it as a key ingredient for successful startups and tech ecosystems. But there’s clearly still work to be done.

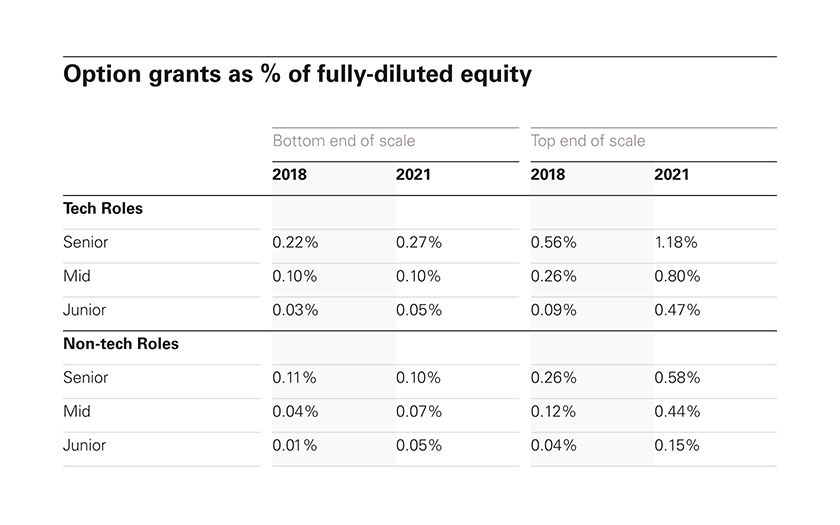

Stock option grant sizes are increasing

At the top end - generally startups with a lot of technical DNA, and weighted towards the Bay Area - we’re seeing much larger grants at all levels and functions at seed stage, in terms of percentage ownership. Senior tech hires in these instances now receive options equivalent to an average 1.18% of fully-diluted equity. The increases are even more pronounced for junior hires, in both tech and non-tech roles.

On the other hand, grants at the bottom end - generally in less tech-heavy sectors such as e-commerce or content - haven’t changed that much in terms of % ownership.

However, even at the bottom-end, stock option grants in dollar-value terms are still larger, since seed valuations have risen so much overall.

ESOP size is increasing at seed stage

With a faster rate of hiring, and larger grants per employee, ESOP pools are being allocated at an accelerating pace compared to previous years. This is particularly true for deep-tech startups. We therefore typically recommend that ESOP size at seed stage is set at 12.5% or 15%, rather than the more traditional 10%. This is increasingly true beyond the US too.

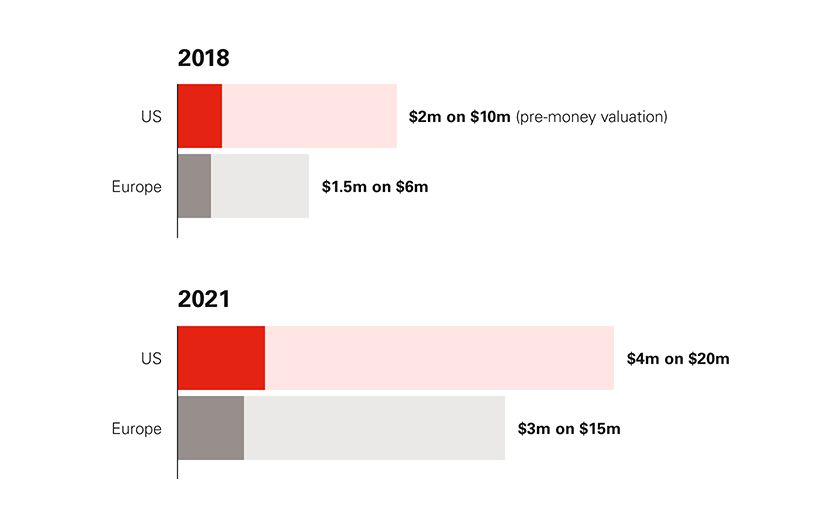

Seed fundraise sizes and valuations have doubled

We analysed seed rounds at Index and other top VCs over the first 6 months of 2021, compared to 2018.

In the US, seed funding rounds, and valuations have both doubled. In Europe, seed funding rounds have also doubled, while valuations have risen by 2.5x.

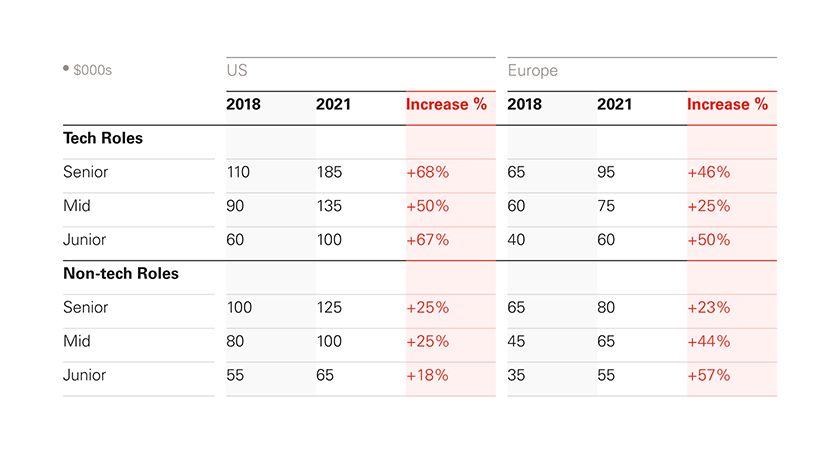

Salaries at seed have risen dramatically

The largest cost bucket for seed stage startups is salaries. So it’s not surprising to see that seed stage employees are being paid way more now than in 2018.

In fact, a key driver of increasing seed fundraise sizes has been to keep up with the demands of a hyper-competitive talent market.

In the US, this is particularly visible for technical roles, with average salaries rising in excess of 60%. Senior tech roles at seed-stage now earn an average $185,000 salary, which is an inflation-dwarfing 68% increase over 3 years. For exceptional candidates in the Bay Area, these salaries frequently rise above $220,000.

In Europe, on the other hand, the biggest salary increases have been for junior roles, both technical and non-technical.

Europe’s technical talent continues to have a compensation gap

Seed-stage technical employees in Europe are still being paid 40-50% less on average than their US counterparts. This gap has actually widened since 2018, despite a narrowing of the gap for non-technical roles.

Variations in salaries across Europe are much wider than the US. This reflects the differences in salaries paid between London as a high-cost hub, and, for example, Bucharest or Warsaw at the lower-end.

Interestingly, for deep-tech startups in Europe’s top hubs, the compensation gap for technical hires has narrowed to 20-25% compared to the US.

As a consequence of this landscape, our belief is that ambitious seed founders in Europe should raise the bar in terms of who they hire, particularly in technical roles. They should target more experienced and higher-calibre candidates, leveraging larger fundraises, in order to pay the higher salaries required to convince them to join. Our experience in the US is that a stellar early team leads to more product momentum, as well as attracting further top quality candidates to join down the line.

Note on Data

We want to thank Advanced HR (part of Solium Capital) for aggregating much of the benchmark data that we used for this analysis. We recommend their Option Impact survey as a great source of compensation data for VC-backed startups.

OptionPlan Seed from Index Ventures

Published — Sept. 15, 2021